Facts about stock market crash of 1929

The first fact to know about the stock market crash of is that a similar crash could happen again in The crash happened when the world was less interconnected. It affected mostly the United States and Europe. The next one will be more inclusive. The Great Depression is the name given to the big economic downturn of the s in the heart of Western capitalist economies following the crisis.

Before breaking down this key historical event, a summary of the stock market crash is necessary.

10 Interesting Facts On The Wall Street Crash of | Learnodo Newtonic

Some historians have gone as far as describing it as a psychological crisis, even more than an economic one. No doubt, the fact that so few had expected the crash of showed that American capitalism suffered from the disease of excessive optimism and self-reference.

The latter point, the self-reference, refers to the tendency of many American investors in the s to ignore what was happening in Europe.

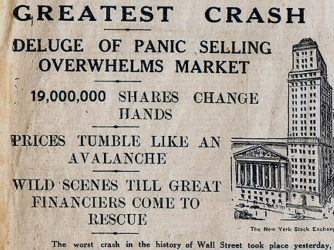

That failure to read clear signals accounted for the shock. Nevertheless, the stock market crash of was a process that lasted a week and three disastrous trading sessions that began on October 24, culminating on Tuesday, October 29, The crash was not a single-day event.

Wall Street Crash of - Wikipedia

The crash began on Thursday, October 24, so-called Black Thursday. The shock factor was considerable, given that the Dow Jones Industrial Average DJIA hit a record high barely a month earlier, on September 3.

Following five years of bullish excess, during which the DJIA increased fivefold and reached a peak of The DJIA started losing its gains during an initial and gradual drop. Stocks entered a yo-yo phase, recovering over half their loss, only to drop again. The decline went into a full tailspin on Black Thursday.

The banks were bamboozled. They reacted just like a hurried driver who ignores the water temperature gauge as it moves toward the red end.

Instead of stopping to check if a fan belt has broken, she or he drives on, hoping the problem fixes itself. Similarly, the banks were relying on the market to fix itself. Thus, they bought more, achieving a recovery.

Black Thursday ended with a 2. On October 25,the markets were quiet. It was that deceitful kind of calm that precedes the worst storms. On that day, over 16 million shares were sold. That was over 10 times the annual budget of the U.

Burns, Ric, James Sanders, Lisa Ades, Steve Rivo, Marilyn Ness, David Ogden Stiers, Buddy Squires, Allen Moore, Brian Keane, and Charlie Rose.

PBS Home Video, As we start to examine what caused the crash ofWorld War I is one of the main causes. This is not to suggest that the cause of the crash was the war itself, which left devastation and millions dead. Rather, World War I set up the markets for the euphoria of the s, the crash ofand the wake-up call of the Great Depression in the s. World War I is the most important of the causes of the stock market crash of The crash occurred as a result of the lopsided development between the U.

Europe was busy reconstructing amid massive social and political changes, marked by instability and the collapse of empires and monarchies. While World War I had destroyed the European industrial powers, it created a unique opportunity for the United States not only to intervene in the conflict militarily and politically, but—more than anything else—it allowed the U. As Europe was struggling—while Russia became the Non qualified stock options tax consequences Union, essentially dropping out of the market altogether—growth was stagnant.

America was growing rapidly but there was no corresponding expansion of the world market. The government kept public spending at a minimum while favoring the emergence of large corporations and the accumulation of private wealth. There was no social assistance in the sense that we understand it today. It was as free a market as there ever was in the 20th century.

To get an idea of the spirit of the age and the colossal inequality that existed between the poor and the rich, watch any Charlie Chaplin movie from that period. Movies such as The Kid or Gold Rush depict the socio-economic context that produced the Great Crash. Or read The Great Gatsby by F.

1929 The Great Crash. - a video about the stock market crash in 1929It was in the s, even more so than in the post-crash years of the Great Depression, that the wage gap widened. Corporate profits increased but wages stagnated. The rich became richer and the upper-middle classes were blinded by optimism in the markets and the prospect of unlimited wealth. This was fueled by the idea that wealth did not have to come from work. It could be achieved at the New York Stock Exchange NYSE. The ruling market sentiment of the s was nothing short of euphoria.

The NYSE set successive records fueled by speculative transactions and the prospect of easy money. The most fashionable financial practice of the age was investing on credit—and buying how to make money on 888 poker on installments. This should sound familiar.

Does the — crisis sound familiar? Does the — stock market rally come to mind? The result was that the real economy became ever more detached from Wall Street and the speculation that ruled it. The Dow Jones rallies of most of the s represented the spread of a wafer-thin economy, increasingly disconnected from the real one.

Simply put, the economy had a weak foundation. Meanwhile, reflecting the financial euphoria, north tyneside core strategy preferred options production produced trade options in an ira many goods for the American market.

The assembly line and innovations in the system of production led the U. Injust before the start of World War I, Henry Ford invented the assembly line. That was one of the most disruptive economic developments in history. It how to make money breeding aquarium fish for unprecedented increases in productivity.

The assembly line meant a sharp reduction in the number of employees in factories. Technological innovations, then as now, forced companies to rationalize. Meanwhile, workers who could, rose to the middle class.

The number of service sector, advertising, and marketing jobs emerged, fueling the rise of a new middle class, susceptible to the market euphoria of the age. The same went for agricultural production. Facts about stock market crash of 1929 was too much of it and not enough markets. Europe, for its part, was too poor to absorb the excess production. Even almost a century ago, the economies of Europe and the United States were financially interdependent.

But, just as in —, in the system started to show the first cracks. In addition to the increasingly unequal distribution of income, inflation increased and the emerging new middle class lost its purchasing power. That meant all that over-abundance of goods was left occupying space on warehouses and factories, unsold. At the same time, the major investment banks were using up their funds to bankroll European consumption, in hopes of fueling the economy.

The stock market crash in New York and the subsequent Great Depression was the first crisis of the capitalist globalization of goods and capital, which Karl Marx had predicted a few decades earlier. But the crisis offered the United States an opportunity to rethink its model of society. The country was forced to rebuild an economic, political, and financial base that was more inclusive of social rights. It left the United States in a better position to face future crashes.

Indeed, the financial crash has had deeper effects than the crash. The effects of the crash went deep. They should be included as one of the causes of World War II.

The effects also helped generate a certain sympathy from prominent European and U. Certainly, the crash and the depression helped bring Adolf Hitler to power. Germany was one of the countries that suffered most from U. Politically, the crash had deep effects. After years of Republican dominance under presidents Calvin Coolidge and Herbert Hoover, the Democratic Franklin Delano Roosevelt entered the White House in The Republicans lost credibility, unable as they were to lead the U.

The real turning point, in terms of trust and hope was Roosevelt, who ushered a new economic and social policy which was called the New Deal.

Signup to receive our FREE Lombardi Letter investment newsletter along with our special offers and get our report:. Proven Stock Market Crash Indicator Just Flashed Red. This is an entirely free service. No credit card required. You can opt-out at any time. We hate spam as much as you do. Check out our privacy policy.

Our Experts Michael Lombardi, MBA Read More John Whitefoot, BA Read More Moe Zulfiqar, BAS Read More Alessandro Bruno, BA, MA Read More Benjamin A. Home About Us Meet our Editors Michael Lombardi John Whitefoot Moe Zulfiqar Alessandro Bruno Benjamin A.

Smith Categories News Stock Market U. This Is Where Jim Rogers Suggests You Invest in The Big American Banks in Are Weak, Sparking a Banking Crisis.

Trump Tax Plan Could Trigger a U. Economic Collapse in Signup to receive our FREE Lombardi Letter investment newsletter along with our special offers and get our report: Proven Stock Market Crash Indicator Just Flashed Red This is an entirely free service. Alessandro Bruno, BA, MA. Threat of Inverted Yield Curve Signaling Possible U. Commercial Loan Growth Signals at U. A Golden Opportunity for Stock Market Investors Click Here to get this report.

The Stock Contraian Investors' Best Play Of the Decade Click Here to get this report. Click Here to get this report. Our Editors Michael Lombardi John Whitefoot Moe Zulfiqar Alessandro Bruno Benjamin A. Categories News Stock Market U. No part of this document may be used or reproduced in any manner or means, including print, electronic, mechanical, or by any information storage and retrieval system whatsoever, without written permission from the copyright holder.