Trading options close to expiration

Options can be dangerous. So if you're going to trade options, you're going to have to master the ins and outs of options expiration. If you come from a directional trading background meaning long or shortthen you probably only focus on where a stock or market is going.

A failure to understand these risks mean that you'll put your portfolio in danger If you're in the dark about the true mechanics of options expiration, make sure you read this before you trade another option. If you buy a stock, it's basically a contract that gives you part ownership of a company in exchange for a price. If you're an option buyer, you can use that contract at any time. This is known as exercising the contract. If you're an option seller, you have an obligation to transact stock.

This is known as assignment. On the third Saturday of the month, if you have any options that are in the moneyyou will be assigned. This process is known as "settlement.

You never will deal directly with the trader on the other side of the option. If you are long options that are in the money, you will automatically begin the settlement process. If you don't want this to happen, you will have to call your broker.

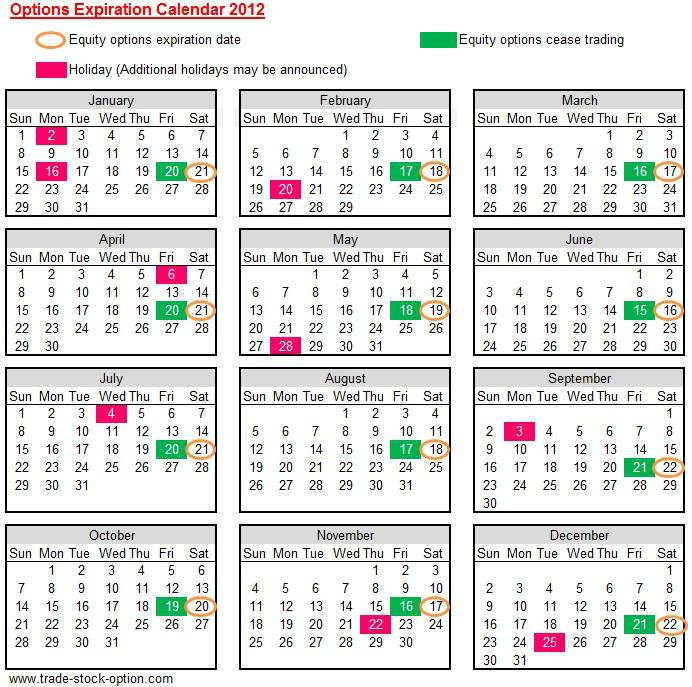

Each option has a price that the buyer can buy or sell the stock-- this is known as the strike price. That's when settlement actually occurs. But since the market's don't actually trade on Saturday, we treat Friday as the effective expiration date. With the introduction of weekly options into the mix, we now have options that expire every single Friday. For monthly SPX options, they stop trading on Thursday, and the settlement value is based on an opening print Friday morning.

These contracts are "cash settled" meaning there is no true assignment but instead you look at the intrinsic value of the options and convert it into cash. Here's where it can get weird. So if you are trading around OpEx with the SPX you need to check if it's a weekly or monthly contract.

How do options trade at expiration? When we look at options pricing, we generally follow a traditional model. We can look at the things that affect the options pricing, known as the greeks. We know that if the option is out of the money, it will have no directional exposure 0 deltaand if the option is in the money it will behave like stock delta.

So there is this discontinuity right at the strike price-- and the gamma of the option can be represented by a "dirac function.

QQQ | Option Trading | trading system

This is where it gets interesting. And this is why you need to be extra vigilant into expiration. If you have a short option that goes in the money into expiration, you must fulfill that transaction. If you don't have enough capital, you will get a margin call on Monday. You also have gap risk. I found on Saturday that the short options had expired in the money, and that I now had a sizeable long position on in BIDU.

I was lucky enough to is stock market halal BIDU gap up the following Monday and I exited for a gain. Make neopets stock market guide when to sell your books are cleared out of all in the money options if you don't want to get assigned.

Nifty Options Selling Strategy - Expiry WeekIf you have a sold call, you will be given a short position if you don't own the stock already. This is known as a "naked" call rather than a "covered" call.

Margin to hold this short is determined by your broker, and to eliminate the short you will have to "buy to close" on that stock. See my full guide on options pinning. Can You Get Assigned Early? There are two types of options: With European-style options, you can't get assigned early. Trading options close to expiration options are American style, but you rarely have early assignment. What if I don't want to get assigned? So you're coming into options expiration with short options that are in the money.

A good rule of forex no repaint indicator is if your option has no extrinsic value time premium left, then you need to adjust your position.

Cara deposit dana ke instaforex of that "gamma impulse" we talked about earlier, the risks and lock position forex trading signals are much, much higher compared to normal options tarding. There's two groups of OpEx trades to consider: Option buying strategies attempt to make money if the underlying stock sees a faster move than what the options are pricing in.

The profit technically comes from the delta directional exposurebut since it is a long gamma trade, your directional exposure can change quickly leading to massive profits in the very short term. The main risk here is time decay. Option selling strategies attempt to make money if the stock doesn't move around that much.

Since you are selling options you want to buy them back at a lower price. And since option premium decays very fast into OpEx, the majority of your profits come from theta gains. Your main risk is if the stock moves against you and your directional exposure blows out.

This is a pure volatility play. If we think the options market is cheap enough and the stock is ready to move, we will buy weekly straddles. As an example, a trade alert was sent out to buy the AAPL If AAPL saw more bb&t stock price today 5 points of movement in either direction, we'd be essay about stock market crash breakeven.

Anything more would be profit. This trade is risky because it has the opportunity to go to full loss in less than 5 days. Position sizing and aggressive risk management is key here. When an individual stock goes parabolic or sells off hard, we will look to fade the trade by either purchasing in-the-money puts or by selling OTM spreads. With the market selling off hard in December and the VIX spiking up, premium in SPX weeklies were high enough to sell them. Once the risk came out of the market, we were able to capture full credit on the trade.

These are high-risk, high-reward trades that speculate strictly on the direction of a stock. Generally a stock will develop a short term technical setup that looks to resolve itself over the course of hours instead of days.

Because of that short timeframe, we're comfortable with buying weekly calls or puts. These trades are made in the chat room only, as they are fast moving and very risky.

These are just some of the trades we take within the IWO Premium Framework. If you feel that it's a right fit for you, come check out our trading service. Weekly options can be exercised and assigned just like any other option. The whole reason it's called an option is because someone has the option to exercise it and hence, assign a seller. What happens when a big chunk of call option expire. I am sure this is no coincidence. Could you explain what is going on?

And what will happen after expiry. Are those options holding the stock down? Options Expiration Explained Options can be dangerous. They have a time limit. That's completely different than how stocks trade. But that is only one part of the option trading equation. It's known as delta.

4 Must Know Options Expiration Day Traps To Avoid

The true risks in the options market come from two things: Theta - the change of an option price over time Gamma - your sensitivity to price movement A failure to understand these risks mean that you'll put your portfolio in danger How Does Options Expiration Work? When it comes down to it, the financial market is all about contracts.

But options are not about ownership. It's about the transfer or risk. It's a contract based on transactions. There are two kinds of options, a call and a put. And you have two kinds of participants, buyers and sellers.

That leaves us with four outcomes: Why don't Out of the Money Options get assigned? If it is "cheaper" to get the stock on the market, then why would you use the option?

The first one, of course. So into expiration, these out of the money options will expire worthless. What are the Options Expiration Dates? For monthly option contracts, the expiration is the Third Friday of each month. There's a handful of "goofy" expiration dates on specific options boards. But when the market heads into options expiration, weird things can happen. It's very similar comparing traditional particle physics with what happens at the quantum level.

There's a concept that I call the "gamma impulse.

It's a Call Option. Comments on this entry are closed. Guest 5 years ago. I've heard that weekly options can't be assigned. Brent 5 years ago.