Exotic binary options

To achieve a proper understanding of the two terms exotic option and double digital option, it is important to that the term option be defined in financial perspectives. Therefore the word option as applied in finance denotes a contract which is used in stock markets. In an option contract the owner of an asset or security bond enjoys the right to sell or buy his or her asset, however the owner of the asset in question does not enjoy the duties to carry out transactions in the stock market without consent from a buyer of the same.

An option can be based on cash or tangible assets such as machinery or electronics. Investor trade stock options for the purposes of reducing the risk attached to changes in the stock market. Trading in stocks also enable investor to leverage on the value of the stock by predicting increase or decline in price.

In the event the stock market experiences problems options also provide insurance to the investor Feldman, , p Exotic options are those options that are more complex in the way they are traded; these options are not very common types of options in the stock market. Exotic options are traded in the Over the Counter OTC platform.

The option enables the trader to choose the trade method, for instance an investor can trade them in put or call options Kuznetsov, , p This category of options are used in the same way as the vanilla options since they have similar features such as money in and money out set of modeling.

The two types can be used in both OTC and Exchange platforms. The other feature of these options is that they elicit random payouts should they be triggered by factor in the stock market. Exotic option is used by investors who are cautious on the market performance rather the performance of the individual stock Kyprianou, , p The payout type of exotic options is the most common method preferred by most traders.

The most common payout models in the stock options include the following, capped payout where the amount to be paid is limited on the disparity that exist between the strike and the limited price suitable in call options and floor price put options.

The payout method is vanilla payout where the amount to be paid is derived from the disparity between the underlying stock price and the strike price.

Binary option - Wikipedia

The last category of the payout system is fixed payout model where the amount to be paid is clarified at the start of the trade period. The element of barrier can be applied to the different types of payout models used in exotic options. Barriers in exotic option are determined by the underlying price and ability of the stock to be active or inactive during the trade period, for instance up-and —out option has a high chance of being inactive should the underlying price go beyond the marked barrier.

Binary Options and Fraud

Down-and-in-option is very likely to be active should the underlying prices of the stock go below the marked barrier. Up-and-in option is very likely to be active should the underlying price go beyond the marked barrier. Limited or capped barriers in exotic options are region based for instance, the most common types of barriers used in the international stock markets may be marked Asian, Indian or European Whaley, R. The graph below shows an option that is on the down-and-out barrier that is inactive, despite the changes in the stock price.

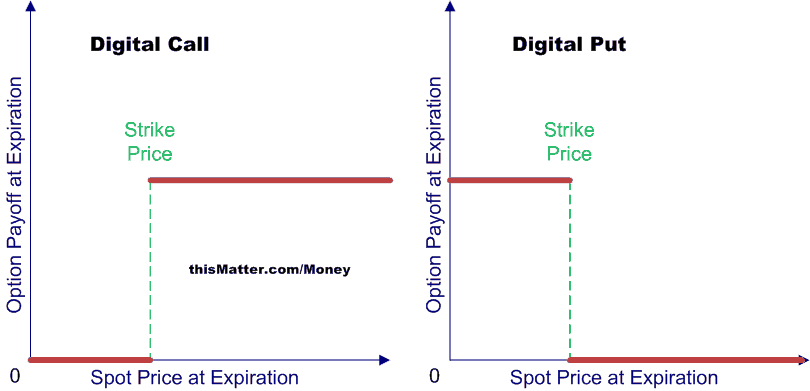

From the graph shown above it is evidenced that the underlying prices of the down-and-out barrier rises the barrier option remains inactive. In such scenarios the investor only gets the strike price and not the total payout expected from the earnings. A double digital option is somehow similar to the exotic option except for a reasons, for instance a double digital option has two strike prices that is the expected price during the trade season.

The option has two types of strikes namely the lower and the upper strikes.

The other thing is that a double digital option does not depend on the performance of the underlying price of the stock. The investor is able to receive the very amount of payout whether the barriers were inactive or not.

The double digital options are the latest types of options in the stock market Whaley, R. Investors are attracted to double digital options due the ability to earn more cash with a short period of time.

Double digital options are risky due to the high earnings attached to them. Double digital options are used in the binary trading system. Investors also prefer to trade their double digital options in binary markets since the payout is subject to the performance of the stocks in the market. Unlike exotic options, the payout for double digital options is constant regardless of the price of the stocks. Investors therefore prefer double digital option due to the fixed method of stock pricing.

Double digital options are also the best options for investors to hedge their stocks against changes in the market such as fluctuation of stock prices due to volatility of stocks in the international market. The payout system is very effective unlike exotic options. The investment procedure for this type of options is very short since most of the processes are digitally handled Feldman, , p The performance of the double digital options in the stock market takes a similar stance to the vanilla payout system of the exotic option, the graphical performance between the two types of options tend to look except that double digital option can either show a constant increase or a decrease in the performance as shown in the graph below.

From the above graph, there is a constant increase in performance of the double digital options throughout the four weeks of the trading period. The option can either show a constant decline or increase. An investor who plans to buy stock options from the stock market should consider the risk factors involved and the payout expected from the investment. The investor should search adequate information on the type of the options to be considered for investment.

For the investor who wants high returns for a short period, double digital options are best in this regard, however they are more risky than exotic options whose returns do not yield within a short period of time. The Complete Guide to Capital Markets for Quantitative Professionals. Exotic Option Pricing and Advanced Levy Models. Understanding, Analysing and Using Models for Exotic Interest-rate Options.

Schneeweis, Thomas, and Richard Spurgin. Exotic And Double Digital Options. Introduction To achieve a proper understanding of the two terms exotic option and double digital option, it is important to that the term option be defined in financial perspectives.

BINARY OPTIONS STRATEGY 2017 - 90% WINS - Most profitable of binary options trading strategiesExotic Options Exotic options are those options that are more complex in the way they are traded; these options are not very common types of options in the stock market.

Double Digital Option A double digital option is somehow similar to the exotic option except for a reasons, for instance a double digital option has two strike prices that is the expected price during the trade season. Conclusions An investor who plans to buy stock options from the stock market should consider the risk factors involved and the payout expected from the investment.

Varies Trusted Broker Minimum Deposit: About, Privacy, Terms, Disclaimer BinaryOptionsBlacklist has financial relationships with some of the products and services mentioned on this website, and may be compensated if consumers choose to click on our content and purchase or sign up for the service. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risks.

You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose.

No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT.

All content on this website is based on our writers and editors experiences and are not meant to accuse any broker with illegal matters. The words Scam, blacklist, fraud, hoax, sucks, etc are used because all content on this website is written in a fictional, entertainment, satirical and exaggerated format and are therefore sometimes disconnected from reality.

All readers must personally judge all content and brokers on their own merits. Additionally, visitors comments are not moderated other than the obvious link spam. Trading binary options is extremely risky and you can lose your entire investment. Only deposit and trade with money you can afford to lose. Always refer to local laws, jurisdictions and authorities before performing any action on the internet. Trusted Broker Minimum Deposit: