Automated stock trading in india

MUMBAI India's "flash boys", or high-frequency traders, are pushing back against the domestic markets regulator and in some cases putting investments in new strategies on hold, saying proposed tighter rules could render their ultra-fast systems redundant. The Securities and Exchange Board of India SEBI last month proposed regulating hyper-fast stock trading, amid concerns that investors lacking access to such advanced and expensive systems were being disadvantaged.

India has been a land of opportunity for HFT players as high transaction costs in some European markets and greater competition in the United States have encouraged international HFT companies to flock to India in recent years.

The Pros And Cons Of Automated Trading Systems

Algo, or automated computer-driven trading of which HFT is a subset, accounts for over 40 percent of executed orders in India, above an estimated average of 32 percent across Asian markets in , according to market research firm Aite Group. The proposed rules, though, are forcing many to hit the pause button. Five HFT firms have told Reuters they are holding back new investments given the uncertainties surrounding the proposed regulations.

SEBI has said it was looking at potential limits on so-called algo traders, including "speed bumps" to randomly delay execution of some orders, and forcing exchanges to take orders from co-located servers and other sources alternatively, removing another advantage enjoyed by HFT platforms.

The deadline for submitting responses to SEBI ended on Aug. SEBI has said it planned to analyze the responses and hold discussions before creating a regulatory framework.

But in a letter sent to SEBI dated Aug. It said they may result in "potentially detrimental impacts to market liquidity, increased risk and increased trading costs for investors which outweigh potential regulatory benefits.

In the discussion paper, SEBI noted that while literature existed showing algo trading helped tighten spreads and boost liquidity, research also showed it may raise costs for non-algo traders and increase the risk of "flash crashes". Regulators in the United States, Europe and elsewhere have moved to crack down on high-speed trading, responding to fears that the practice distorts markets, ups risks and disadvantages retail and institutional investors.

Authorities in Asia-Pacific markets, where HFT is generally less of a factor, have also stepped up scrutiny of algo trading over the past two years, and in some cases introduced curbs to curtail it.

Most notably, China's securities watchdog has investigated a number of automated trading firms and proposed far-reaching electronic trading restrictions after the market rout of The Bombay Stock Exchange BSE Brokers Forum, in a letter to SEBI last week, appealed for more time to deliberate.

The proposals, if implemented, could take a chunk out of the revenues of BSE and the National Stock Exchange, India's biggest bourse, just as both exchanges are gearing up to go public. Some foreign players are also wary of the proposed changes, concerned they could widen spreads and make markets more prone to sudden swings, all at a time when India is increasingly attractive to overseas investors.

Automated Trading System India | symphony

Additional reporting by Michelle Price in Hong Kong, Savio Shetty in Mumbai and John McCrank in New York; Editing by Mike Collett-White. NEW DELHI India on Wednesday allowed banks and post offices to exchange old, big bank notes, which are no longer in circulation, with the Reserve Bank of India RBI in a month, provided these notes were collected by Dec.

NEW DELHI Air India and Jet Airways will start additional flights to Doha from this week to bring back stranded Indian nationals, after some Gulf countries led by Saudi Arabia cut ties with Qatar, a government statement said on Wednesday.

Reuters is the news and media division of Thomson Reuters. Thomson Reuters is the world's largest international multimedia news agency, providing investing news, world news, business news, technology news, headline news, small business news, news alerts, personal finance, stock market, and mutual funds information available on Reuters.

Learn more about Thomson Reuters products:. All quotes delayed a minimum of 15 minutes. See here for a complete list of exchanges and delays.

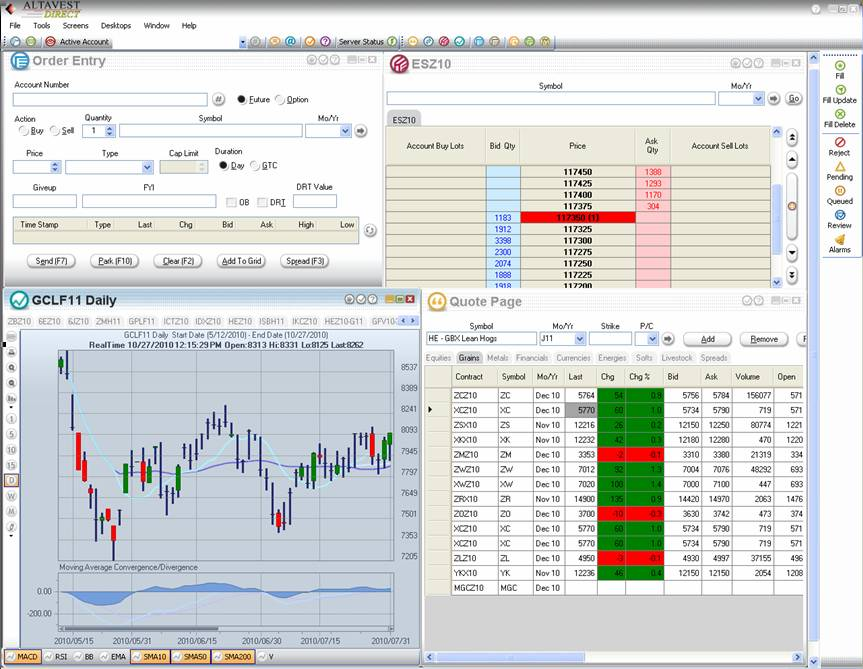

Best Online Automated Trading Systems Software - Altavest

Markets Home Stocks India Markets US Markets Currencies Commodities. Elections Top News India Insight Monsoon Top News Video.

World Home South Asia Middle East Special Reports Reuters Investigates World Video. Technology Home Science Tech Video Innovation.

Commentary Home Expert Zone. Breakingviews Home Breakingview Videos. Money Home Stock Screener Fund Screener. Sports Lifestyle Bollywood Entertainment Oddly Enough Health Arts Lifestyle Video. Pictures Home The Wider Image Photographers Focus India's "flash boys" fret over proposed automated trading curbs. Money News Thu Sep 8, 9: A broker looks at a computer screen while trading at a stock brokerage firm in Mumbai November 11, By Abhirup Roy and Euan Rocha MUMBAI.

Also In Money News. The Thomson Reuters Trust Principles. Live updates from markets and economy. Follow Us On Twitter Follow Us On Facebook RSS Follow Us On LinkedIn.

Reuters News Agency Brand Attribution Guidelines Careers. Learn more about Thomson Reuters products: Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Everything you need to empower your workflow and enhance your enterprise data management. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks.

Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology. The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs.

The industry leader for online information for tax, accounting and finance professionals.