Forex trading strategies - support and resistance

Oil Crumbles, Cable Reverses and the Dollar Continues with Bullish Structure. GBP Reacts to CB Talk as the Queen Speaks. Gold, USD Strong Inverse Correlation and in Confluence. FTSE Further Develops Range on Sharp Turn Lower. Dow Jones Industrial Average Struggles to Hold the Gap Higher. Over this series of articles, we will walk traders through the multiple-step process of building a trading strategy. The first installment in the series discussed market conditions. The second looked at the available chart time frames.

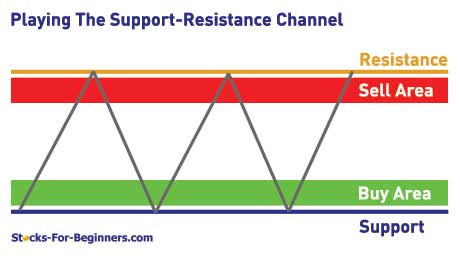

This is the third entry, in which we will investigate the mechanism of Support and Resistance. S upport and resistance have a recurring nature as a trader goes through the process of building a strategy. Because of its importance , it often behooves the trader build objective mannerisms for incorporating these prices into the strategy.

When strong support and resistance levels are found, this can enable traders to effectively plot their approach, manage trades, and adjust risk levels. This article will discuss various mannerisms for identifying support or resistance so that traders can begin appropriately addressing this element of their strategy design. Many traders consider price action to have special relevance when identifying support and resistance for one very compelling reason: The market has actually traded this asset at those specific levels.

For instance, if I observe that price has bounced off of. The fact that price had reflected off of this level simply points out to us that the market resisted at. As human beings, we think in round numbers. Odds are, if someone asked me how much I paid for my car I would use a round number. And odds are, you would do something similar if posed with a comparable question.

Forex Trading Strategies And Systems

As human beings, we innately value this simplicity. We automatically round figures up or down to save time. This happens in our trading as well. Many traders will often place stops or limits right at these levels, such as 1. EURUSD playing with the 1.

• Daytrading and forex training for forex day trading, stock market trading and emini trading

This acts as a brick wall, stopping and reversing price - pushing lower. Often times, traders consider prices ending in on major currency pairs such as 1.

Traders have even taken this a step further to look at prices ending in 50 pip increments such as 1. Not every one of these levels will function as strong support or resistance, but many of these levels will provide traders will additional perspective. During uptrends, prices can often congest on the way up, resisting around whole numbers. And during downtrends, oftentimes, the same can be witnessed. There are numerous flavors of Fibonacci studies, but for purposes of this article we will focus on the more popular, or Fibonacci retracements.

To plot a Fibonacci retracement, one needs only to observe a trend. Most charting packages have Fibonacci drawing tools readily available in which the trader can indicate the period to be analyzed.

The tool will then draw levels at pre-determined intervals intervals based on the Fibonacci mathematical sequence.

The price levels with which these intervals are drawn will often be thought of as support in up-trends that are facing a retracement as seen below. Trend traders will often anticipate the original trend coming back into the equation; looking to enter the trade in the original trend-side direction as these prices get hit. So, in the case of a long-term downtrend, the trader can denote the trend on the chart as seen below.

As price comes back to these levels while the downtrend is being re-traced, the trader can look to enter a trade in anticipation of the downtrend coming back into force. This is only one way that Fibonacci levels can be traded, but the thing to keep in mind is that this is another way that traders identify support and resistance. Each trader will often have their own vantage point on Fibonacci; with many ardent zealots while others would prefer to use other mechanisms such as Price Action, or Pivot Points.

At its core, pivot points are merely calculations based on past price behavior that can provide an idea of potential support and resistance.

Monthly Pivot Points on a Daily Chart; Created by James Stanley. What is compelling about pivot points is how often they function as support and resistance despite these prices merely being products of a mathematical function.

To calculate floor trader pivots, you take the high, the low, and the close of the previous period and you divide them by 3. Pivots can be calculated on any timeframe, but often — the longer the timeframe the more pertinent the level.

There are also different flavors of these levels, such as Camarilla Pivots, which are often preferred by short-term traders as they use a different mathematical equation that often provides levels much closer to current price than floor-trader pivots. Well, it depends on your strategy. None of the aforementioned support and resistance levels have any predictive behavior.

But these levels can help traders build their approach to work with those probabilities; looking to limit risk while maximizing gains. The Forces of Supply and Demand 6 of You can follow James on Twitter JStanleyFX. How to Build a Strategy, Part 1: How to Build a Strategy, Part 2: The Time Frames of Trading.

Trading Psychological Whole Numbers. Attacking News Events with Price Action. How to Trade Panic. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Market News Headlines getFormatDate 'Wed Jun 21 Technical Analysis Headlines getFormatDate 'Wed Jun 21 Gold, USD Strong Inverse Correlation and in Confluence getFormatDate 'Wed Jun 21 Education Beginner Intermediate Advanced Expert Free Trading Guides.

Click here to dismiss.

Get Your Free Trading Guides With your broad range of free expert guides, you'll explore: News getFormatDate 'Wed Jun 21 News getFormatDate 'Tue Jun 20 How to Build a Strategy, Part 3: Support and Resistance getFormatDate 'Tue Jun 19 Market Conditions getFormatDate 'Thu Jun 14 Upcoming Events Economic Event.

Forex Economic Calendar A: NEWS Articles Real Time News Daily Briefings Forecasts DailyFX Authors.

Forex Trading Strategies - Trade from the Daily Charts Learning Forex

CALENDAR Economic Calendar Webinar Calendar Central Bank Rates Dividend Calendar. EDUCATION Forex Trading University Trading Guide. DAILYFX PLUS RATES CHARTS RSS. DailyFX is the news and education website of IG Group.