Spread futures contract

Commodity spreads or straddles measure the price difference between two different contracts, usually futures contracts. The price difference is often analyzed in special futures spread charts. Spreads can also measure the difference between a cash contract and a futures contract referred to as the basis or the price difference between two option contracts, or various combinations of the above.

For the purpose of this section you will examine spreads from the context of the price difference between two different futures contracts. In the grain business the difference between two contract months of the same commodity ie. Carrying charges are determined by the cost of interest and storage when physical commodities are held in store. Grain traders will monitor spread relationships very closely as the relative difference between various contract positions will determine the handling margins or profitability of their involvement in marketing grain.

When using spreads, the trader hopes to profit by changes in the spread difference between the two contracts. The trader is looking for either a widening or narrowing of the spread relationship over time. Spread trading is considered to be a less risky and often less expensive way in which to participate in the futures market.

Margin requirements for spreads are generally lower than outright long or short positions, and whether the price increases or decreases the traders risk is limited to the change in the spread, since both a long and a short position are held at the same time. Since the risk is lower, so will be the potential for profit or loss. Spread trading is more complicated than outright trading and requires a higher degree of sophistication on the part of the trader.

You will examine only briefly the application of spread trading to farm marketing management in this course. The purpose of this section is to familiarize yourself with the use of commodity spreads in forecasting market direction.

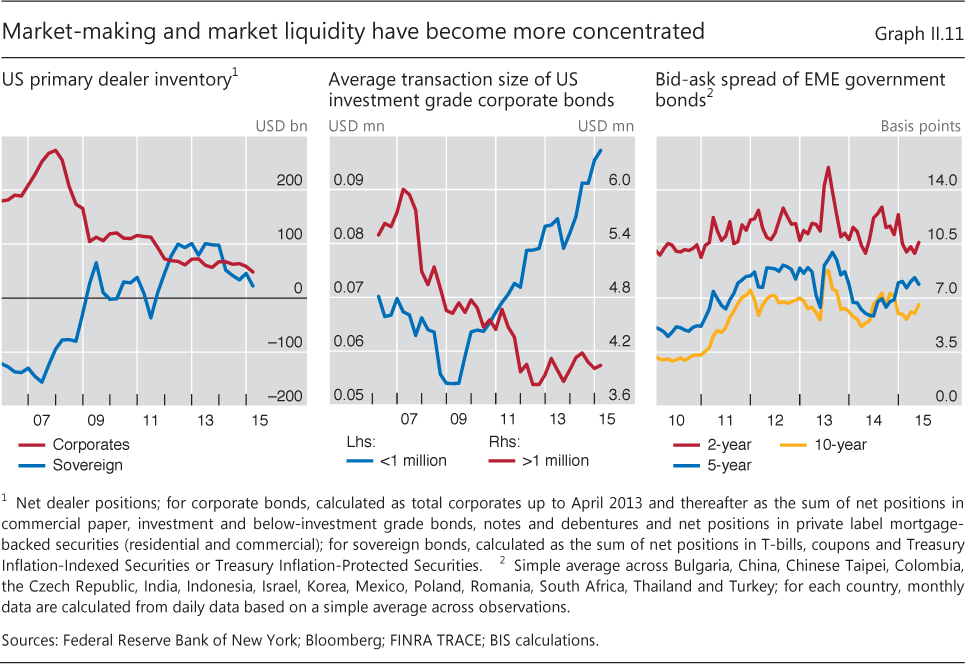

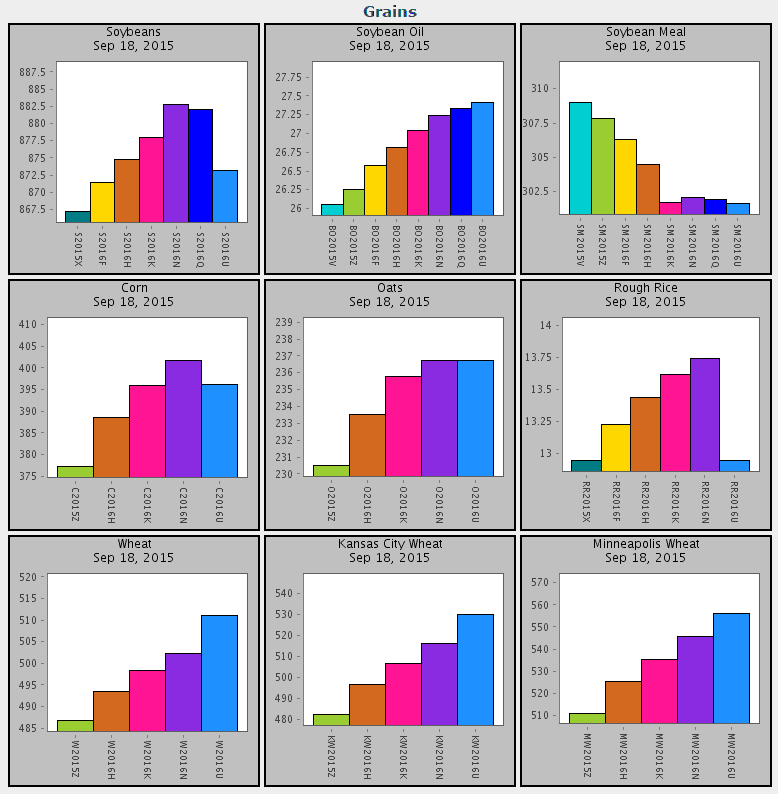

Commodity Spreads and Spread Charts

By monitoring the relative strength between various contracts and between different markets, you will be better able to select the appropriate pricing and risk management strategies when developing your marketing plan. Note that TradingCharts offers premium, customizable spread charts.

Spread trade - Wikipedia

Click here for more information. Besides being used for spread trading, tracking the spread relationships between different contracts in the same market or in different markets can provide useful insights into future price direction. The relationships between the nearby and the distant months in the same commodity often tell us about the relative strength or weakness of the market itself.

For example; the June Canola contract traded at a substantial premium to the November, contract up until May A perceived shortage of top quality canola following the frost of August resulted in canola values gaining on the contract positions. This relationship continued until it became apparent later in the marketing year that an adequate supply of canola was available to satisfy buyer's needs in addition to farmers' requirements for cash flow prior to seeding a new crop.

In situations such as this, caused by perceived tightness of stocks, the nearby months will usually rise faster than the distant months. This is referred to as a bull spread.

Futures contract - Wikipedia

In order to profit from this relationship you would buy the nearby futures contract and simultaneously sell the more distant contract. Conversely in situations where the near term supplies are in relative over abundance in relation to future supplies, the nearby months will usually fall faster than the distant months.

A bearish approach to the market would be undertaken by entering a bear spread.

In order to profit from this relationship you would sell the nearby contract month and buy the distant contract month. By monitoring the relationship between the nearby and the distant months, you often will be provided with a lead indication as to whether the market will trend higher or lower.

Chart Patterns ] -- [ CONTENTS ] -- [ NEXT: See TradingCharts' Privacy Statement. Glossary Glossary Index A through C D through I J through O P through R S through Z Short Course Short Course Index History of Futures Trading What Is Traded? Inside Futures Exchanges The Futures Contract Market Pressures Who Trades Futures?

The Clearing House Market News and Analysis Taking A Position Taking Delivery Options on Futures A Safety Net of sorts Learning Center: Commodity Spreads and Spread Charts Learning Center. Technical Indicators ] This educational material is provided courtesy of Keystone Marketing Services, a leader in commodity market training. For more futures market learning opportunities, check out their interactive CDRom training courses. Binary Options Articles TFC Commodity Forum Learn to Trade Futures Commodity Brokers Directory Contract Specifications.

HOME COMMODITY CHARTS COMMODITY QUOTES MY MENU FUTURES NEWS PREMIUM FEATURES FOREX CHARTS FOREX QUOTES STOCKS. Commodity Spreads and Spread Charts Learning Center Commodity spreads or straddles measure the price difference between two different contracts, usually futures contracts. This educational material is provided courtesy of Keystone Marketing Services, a leader in commodity market training.

Resources for Traders Binary Options Articles TFC Commodity Forum Learn to Trade Futures Commodity Brokers Directory Contract Specifications.

Market data is delayed at least 10 minutes. Access to this website and use of this market data is subject to the following: It is also a condition of access to this website that you agree to not copy, disseminate, capture, reverse engineer or otherwise use information provided on this site for any other purpose except for the direct display in Internet browser of the end user only, and only in the format provided.