Binomial option pricing discrete dividend

This article builds upon the American option pricing model posted by Andrew Peters and lets you value options on stocks, futures, currencies, and stock indices with discrete or continuous dividends.

This project was written as part of my Options pricing class to create a Binomial Option Pricing model that could handle several types of options, including those on underlyings with discrete dividends.

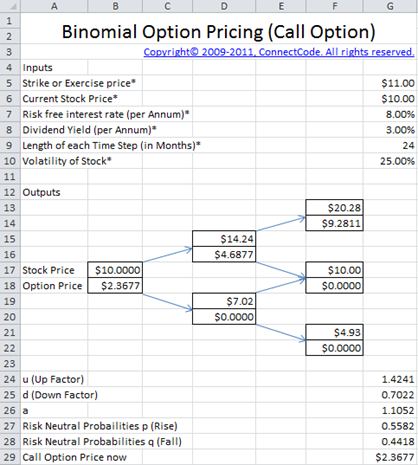

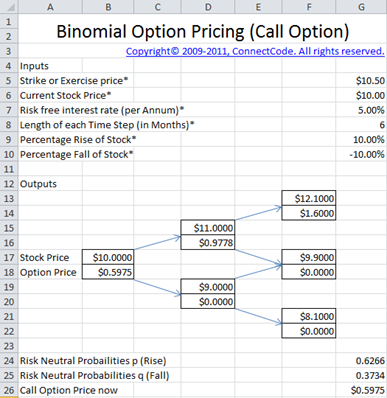

The binomial options pricing model provides a generalizable numerical method for the valuation of options and was first proposed by Cox, Ross, and Rubinstein The model uses a "discrete-time" model of the varying price over time of the underlying financial instrument.

According to this model, an option's price at any moment in time can have two possible future states - up or down. Option valuation is then done via application of the risk neutrality assumption over the life of the option, as the price of the underlying instrument evolves.

While the Black-Scholes-Merton formula requires that the option be European style, the Binomial models can handle American style options with ease. At any point of time, the value of the option is the maximum of the value calculated via its child nodes and the intrinsic value of the option. The Black-Scholes-Merton formula also assumes no dividend payouts while the Binomial model can handle dividend payments - thus making it flexible enough to handle currencies, stock options, futures, and index options.

I created a BinomialTree class that is used for interfacing between the Windows Form and the TreeNodeFactory class. This class invokes the methods necessary to create the binomial lattice and do the aggregate calculations over it.

The TreeNodeFactory is used to create objects of TreeNode. Each TreeNode instance represents - you guessed it - a node in the binomial tree. The factory maintains an ArrayList of all the TreeNode objects it creates and allows you to create, fetch, and delete TreeNode s in the binomial lattice. The enumeration EnumStyle represents whether the option is American or European. The enumeration EPutCall from Andrew Peter's code is used, and represents whether the option is a put or a call.

In the code above - the step variable is used to represent a step in the binomial lattice. For instance - a 12 step lattice for an option maturing in one year would have each step of one month's duration.

The level is a representation of the row number.

Fast Trees for Options with Discrete Dividends by Nelson Areal, Artur Rodrigues :: SSRN

The first node - representing the current time - will be step zero and level 1. The next step would have two nodes -level 1 and 2, and so on. For the last step in the binomial lattice, the payoffs are calculated using the formula for intrinsic value of an option - Max S-K for calls and Max K-S for puts.

For nodes at all preceding levels, the node values are calculated using the maximum of either the intrinsic value, or the value calculated using:. While this model can handle continuous dividend yields by simply factoring that value into its calculation of p , handling discrete dividends requires some extra work.

This approach is suggested by Hull in his excellent treatise on option pricing: Options, Futures, and other derivatives 6 th edition. We simply discount the present value of all dividends from the initial price of the underlying, when creating the tree. Then, at each node, we add the present values of the dividends at that point in time.

We modify CreateStockPriceTree to the code below:. The code in TreeNode that adds back the dividend present values to the node's stock price is:. Please note that in the entire project, the dates used are not calendar dates but lengths of time in years.

If you want to extend it to use actual dates, it should be a trivial change.

The computation of option values proceeds in the same way for discrete dividends as it did before. I would be delighted to hear your comments, suggestions, or idle chatter.

Binomial options pricing model - Wikipedia

Please email me at tanveeransari hotmail. This article, along with any associated source code and files, is licensed under The Code Project Open License CPOL. Articles Quick Answers Messages. Option pricing with discrete dividends using the Binomial Tree model.

Option Pricing & Stock Price Probability Calculators | Hoadley

Tanveer Ansari 1 , 17 Jun Please Sign up or sign in to vote. Pricing European and American call and put options using the binomial tree model. Handles discrete dividends paid on underlying. Download source code - Architecture I created a BinomialTree class that is used for interfacing between the Windows Form and the TreeNodeFactory class. For nodes at all preceding levels, the node values are calculated using the maximum of either the intrinsic value, or the value calculated using: TreeNode handles these valuations and sets its option price: We modify CreateStockPriceTree to the code below: Feedback I would be delighted to hear your comments, suggestions, or idle chatter.

Tanveer Ansari 1 Software Developer Senior. Tanveer Ansari specializes in application of. NET and Java to building automated trading systems. He also builds statistical time series and bayesian models to predict asset prices. He is available for technology consulting for the financial markets at info tanveeransari.

Getting the Most out of Your Infrastructure: Dev and Test Best Practices.

Not Found

Discrete Event Simulation using R: SAPrefs - Netscape-like Preferences Dialog. Option Pricing using the Binomial Tree Model in C. Generate and add keyword variations using AdWords API.

You must Sign In to use this message board. Permalink Advertise Privacy Terms of Use Mobile Web01 2. Article Browse Code Stats Revisions 3 Alternatives Comments 1 Add your own alternative version Tagged as. NET Visual-Studio Dev Intermediate Stats Option pricing with discrete dividends using the Binomial Tree model Tanveer Ansari 1 , 17 Jun Pro The Hybrid Cloud.

Pro Getting the Most out of Your Infrastructure: I'm going to download it after work and test it out.