Employee stock option valuation early exercise boundary

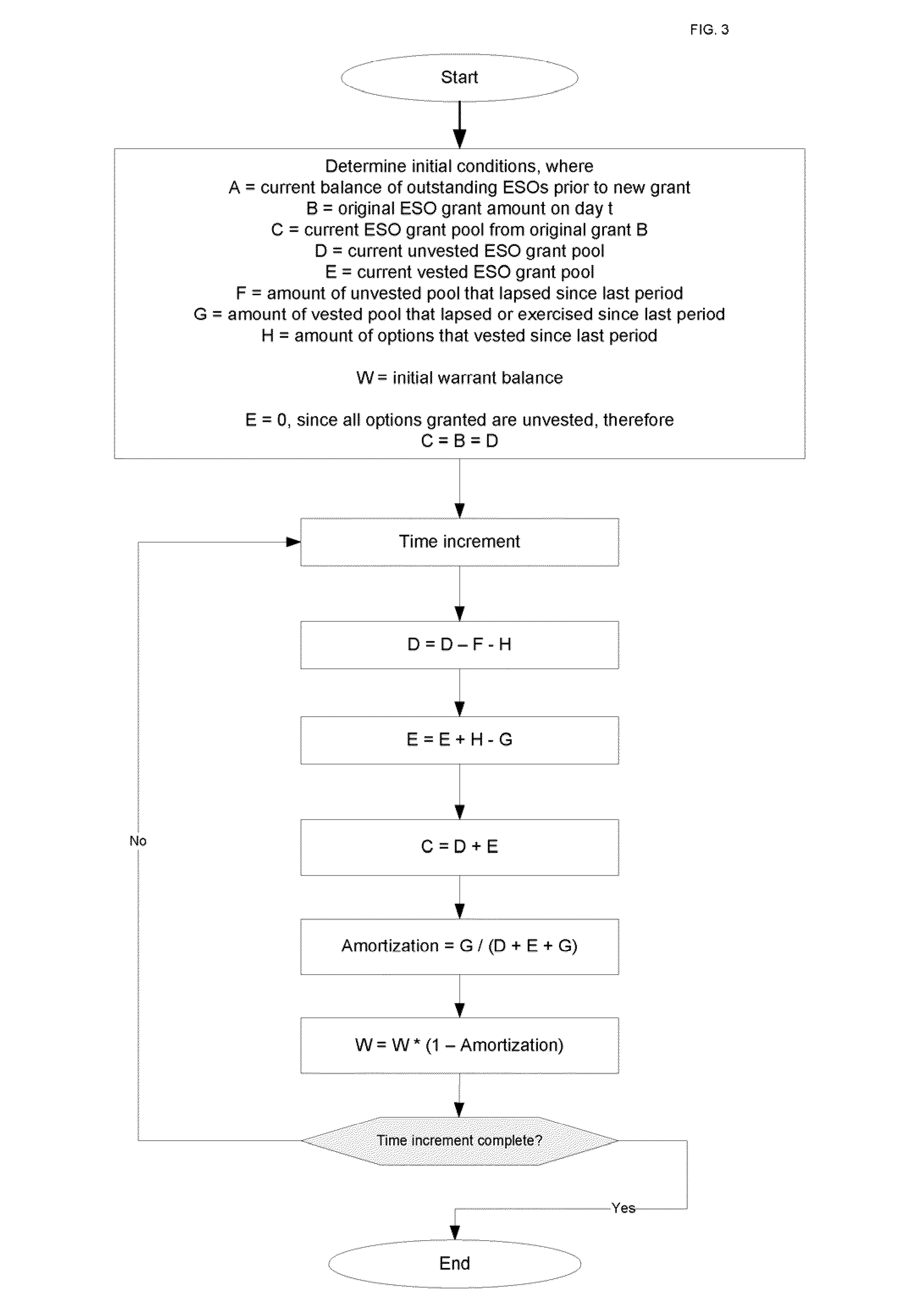

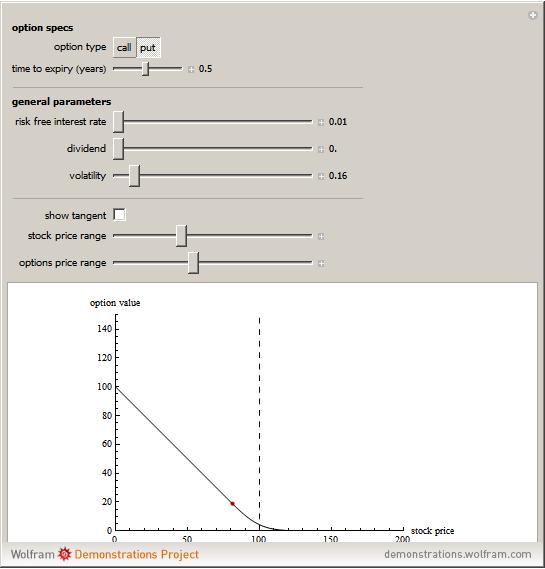

Financial Analysts Journal, Vol. Many companies are recognizing that the Black-Scholes formula is inappropriate for employee stock options ESOs and are moving toward lattice models for accounting or decision-making purposes. In the most influential of these models, the assumption is that employees exercise voluntarily when the stock price reaches a fixed multiple of the strike price, effectively introducing a horizontal exercise boundary into the lattice.

In practice, however, employees make a trade-off between intrinsic value captured and the opportunity cost of time value forgone. The model proposed here explicitly recognizes and accounts for this reality and is intuitively appealing, easily implemented, and compliant with U. The paper on which this article is based won the Second Annual Best Conference Research Paper Award from the Canadian Finance Executives Research Foundation at the Financial Executives International FEI Canada conference.

Financial Statement Analysis, Accounting and Financial Reporting Issues, Equity Investments, Fundamental Analysis and Valuation Models, Corporate Finance, Other. Brisley, Neil and Anderson, Chris K.

"Employee Stock Option Valuation with an Early Exercise Boundary" by Neil Brisley and Chris K. Anderson

Subscribe to this fee journal for more curated articles on this topic. Cookies are used by this site. To decline or learn more, visit our Cookies page. This page was processed by apollo6 in 0.

Your Account User Home Personal Info Affiliations Subscriptions My Papers My Briefcase Sign out. Not Available for Download Share: Using the URL or DOI link below will ensure access to this page indefinitely.

Neil Brisley University of Waterloo - School of Accounting and Finance Chris K.

Employee Stock Option Valuation with an Early Exercise Boundary by Neil Brisley, Chris K. Anderson :: SSRN

Anderson affiliation not provided to SSRN. Abstract Many companies are recognizing that the Black-Scholes formula is inappropriate for employee stock options ESOs and are moving toward lattice models for accounting or decision-making purposes. Neil Brisley Contact Author University of Waterloo - School of Accounting and Finance email University Avenue West Waterloo, Ontario N2L 3G1 Canada x Phone.

Anderson affiliation not provided to SSRN email.

to Employer further guide to PAYE and NICs - efulejeqih.web.fc2.com

Not Available for Download. Paper statistics Abstract Views.

Related eJournals Corporate Finance: Derivatives eJournal Subscribe to this fee journal for more curated articles on this topic FOLLOWERS. Personnel Economics eJournal Follow. Personnel Economics eJournal Subscribe to this fee journal for more curated articles on this topic FOLLOWERS. Eastern, Monday - Friday. Submit a Paper Section Text Only Pages.

Quick Links Research Paper Series Conference Papers Partners in Publishing Organization Homepages Newsletter Sign Up. Rankings Top Papers Top Authors Top Organizations. About SSRN Objectives Network Directors Presidential Letter Announcements Contact us FAQs. Copyright Terms and Conditions Privacy Policy.