What is margin used in forex

Oil Crumbles, Cable Reverses and the Dollar Continues with Bullish Structure. GBP Reacts to CB Talk as the Queen Speaks.

Gold, USD Strong Inverse Correlation and in Confluence. FTSE Further Develops Range on Sharp Turn Lower.

Dow Jones Industrial Average Struggles to Hold the Gap Higher. Short Term Strategies, Scalping, Price Action Analysis, and Risk Management.

Leverage, Margin, Balance, Equity, Free Margin, Margin Call And Stop Out Level In Forex Trading

Using margin in Forex trading is a new concept for many traders, and one that is often misunderstood. Margin is a good faith deposit that a trader puts up for collateral to hold open a position.

More often than not margin gets confused as a fee to a trader. It is actually not a transaction cost, but a portion of your account equity set aside and allocated as a margin deposit.

Trading Forex avec efulejeqih.web.fc2.com | efulejeqih.web.fc2.com

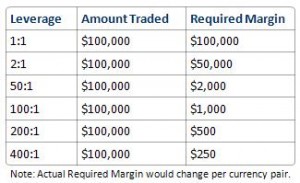

When trading with margin it is important to remember that the amount of margin needed to hold open a position will ultimately be determined by trade size.

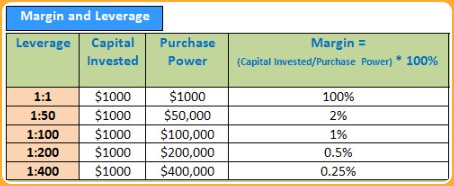

As trade size increases your margin requirement will increase as well. Leverage is a byproduct of margin and allows an individual to control larger trade sizes.

Traders will use this tool as a way to magnify their returns. Therefore, it is important to understand that leverage needs to be controlled. Using leverages can have extreme effects on your accounts if it is not used properly. Trading larger lot sizes through leverage can ratchet up your gains, but ultimately can lead to larger losses if a trade moves against you.

Below we can see this concept in action by viewing a hypothetical trading scenario. Trader A used his account to lever his account up to a , notional position using 50 to 1 leverage.

Trader B traded a more conservative 5 to 1 leverage taking a notional position of 50, So what are the results on each traders balance after a pip stop loss?

Trader B on the other hand fared much better. Through leverage management Trader B can continue to trade and potentially take advantage of future winning moves. Typically traders have a greater chance of long-term success when using a conservative amount of leverage. Keep this information in mind when looking to trade your next position and keep effective leverage of 10 to 1 or less to maximize your trading.

To contact Walker, email WEngland DailyFX. Interested in learning more about Forex trading and strategy development?

Understanding Leverage in Forex Trading | OANDA

Register here to continue your Forex learning now! DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Market News Headlines getFormatDate 'Wed Jun 21 Technical Analysis Headlines getFormatDate 'Wed Jun 21 Gold, USD Strong Inverse Correlation and in Confluence getFormatDate 'Wed Jun 21 Education Beginner Intermediate Advanced Expert Free Trading Guides. Click here to dismiss.

Get Your Free Trading Guides With your broad range of free expert guides, you'll explore: News getFormatDate 'Wed Jun 21 News getFormatDate 'Tue Jun 20 Short Term Strategies, Scalping, Price Action Analysis, and Risk Management Connect via: Upcoming Events Economic Event.

Forex Economic Calendar A: NEWS Articles Real Time News Daily Briefings Forecasts DailyFX Authors.

How to Calculate Leverage, Margin, and Pip Values in Forex, with Examples

CALENDAR Economic Calendar Webinar Calendar Central Bank Rates Dividend Calendar. EDUCATION Forex Trading University Trading Guide. DAILYFX PLUS RATES CHARTS RSS. DailyFX is the news and education website of IG Group.