Buy eurusd sell usdchf

If you're interested in getting into the forex market , there is one relationship that you must be aware of before you even start trading: In this article we explain what causes this relationship, what it means for trading, how the correlation differs on an intraday basis and when such a strong relationship can decouple.

Read on and you'll also find out why, contrary to popular belief, arbitraging the two currencies to earn the interest rate differential , does not work. Where Does This Relationship Come From? Over the long term, most currencies that trade against the U.

buy eurusd = sell usdchf ?

This is the case because the U. As a country surrounded by other members of the eurozone, Switzerland has very close political and economic ties with its larger neighbors. The close economic relationship began with the free trade agreement established back in and was then followed by more than bilateral agreements. These agreements have allowed the free flow of Swiss citizens into the workforce of the European Union EU and the gradual opening of the Swiss labor market to citizens of the EU.

The two economies are very intimately linked. Therefore, if the eurozone contracts, Switzerland will feel the ripple effects. Meanwhile, if we are long one and short the other, we are actually doubling up on the same position, even though it may seem like two separate trades.

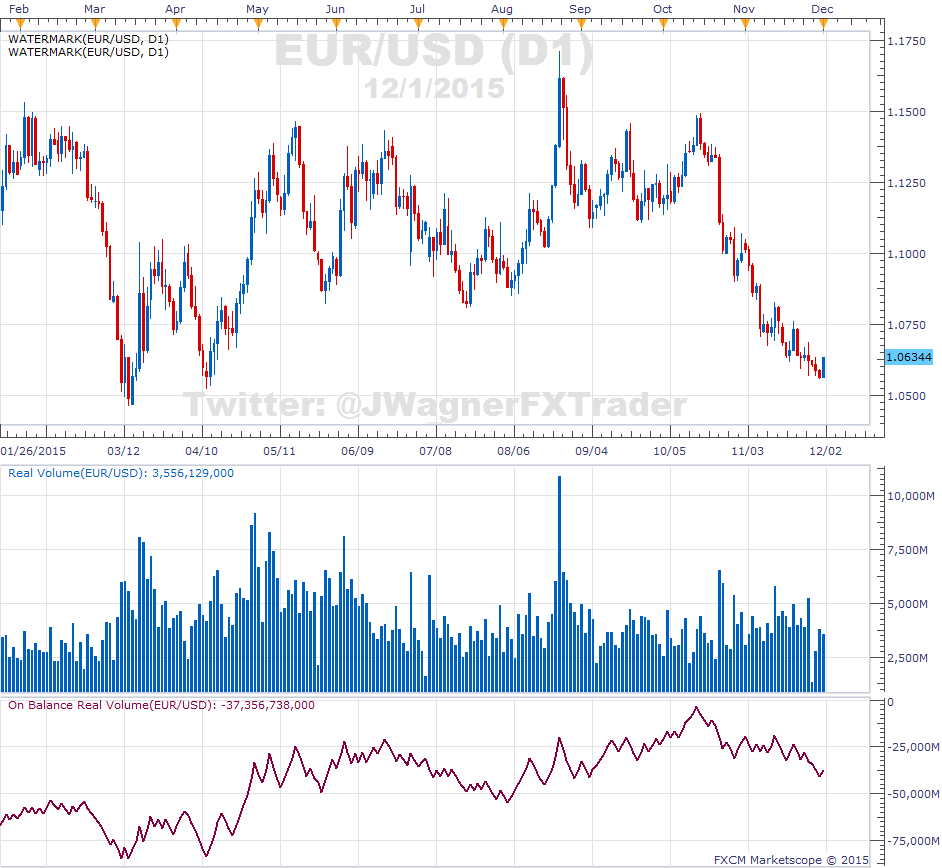

This is very important to understand for proper risk management , because if something goes wrong when we are short one currency pair and long the other, losses can easily be compounded. Intraday Relationship This may be less of a problem for you if you are trading on an intraday basis, because the correlation is weaker on shorter time frames. Just take a look at the chart in Figure 2, showing one-week's worth of hourly bars.

The reason for this variance is the possible delayed effect of one currency pair on the other. Why Arbitrage Does Not Work Nevertheless, with such strong correlation, you will often hear novice traders say that they can hedge one currency pair with the other and capture the pure interest spread.

What they are talking about is the interest rate differential between the two currency pairs. This meant that if you were long the EUR, you would earn 2. By contrast, the interest rate spread between the U. This may seem like a lot of work to you for a mere 1.

Best Exchange Rates - TorFX

Therefore, even a conservative 10 times capital turns the 1. The general assumption is that leverage is risky, but in this case, novices will argue that it is not, because you are perfectly hedged.

Unfortunately, there is no free lunch in any market, so although it may seem like this may work out, it doesn't. Therefore, when these two pairs move in opposite directions, they are not necessarily doing so to the same degree. The best way to get rid of the misconceptions that some traders may have about possible arbitrage opportunities, is to look at examples of monthly returns for the 12 months of the previous year. The table in Figure 3 shows the price at the beginning of the month and at the end of the month.

The difference represents the number of points earned or lost. Some may argue that you need to neutralize the U. As shown in Figure 4, the negative profit turns into a positive return, which may seem great at first glance, and may prompt many traders to buy into this idea. The table in Figure 6 shows the results of when we neutralized the dollar exposure and saw the profit turn into a loss.

The fact that the numbers diverge so significantly, when theoretically they should not have been that different, because we are looking to earn just the pure interest rate differential, tells us that no matter how you cut it, the two currencies cannot be hedged perfectly.

However, taking a look at the chart in Figure 7, we see that this is not the case. When Does the Relationship Decouple? Basically, the fact that ranges of the two currencies can vary more or less than the point difference, is the primary reason why interest rate arbitrage in the FX market, using these two currency pairs, does not work. The Bottom Line Forex trading can be very profitable, if you know what you're doing and don't get fooled by misconceptions, and understanding the relationships between currencies is essential.

Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

What Does This Mean for Trading? Figure 2 Why Arbitrage Does Not Work Nevertheless, with such strong correlation, you will often hear novice traders say that they can hedge one currency pair with the other and capture the pure interest spread. Knowing the relationships between pairs can help control risk exposure and maximize profits. Gain a trading edge by learning how macroeconomic forces play out differently for various pairs in the forex market.

The Fed may raise interest rates this summer and the ECB has begun a quanitative easing program. If you are following a range-trading strategy, you're better off with pairs that do not include the U. Tap into a world of possibilities by going beyond the simple pro- or anti-dollar trade. The Swiss franc is one of the safe havens of the investing world. Learn how invest through ETFs, forex, futures, and binary options. Three empirical findings on futures data can help currency traders determine buy and sell points.

Those that are able to capitalize on this rather obscure report will benefit immensely from it. Diverse reporting schedules keeps Swiss franc forex markets active and liquid between midnight and noon U. Learn how the pip is used in the pricing of a currency pair in forex trading, and see how the foreign exchange market is How someone makes money in forex is a speculative risk: All currencies are traded in pairs. The first currency in the pair is called the base currency while the second is called In a currency pair, the first currency in the pair is called the base currency and the second is called the quote currency.

The forex market allows individuals to trade on nearly all of the currencies in the world.

However, most of the trading is No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.