Stock market during recession

It has been expanded and updated. What is a bear market?

Investopedia defines a bear market as:. A market condition in which the prices of securities are falling, and widespread pessimism causes the negative sentiment to be self-sustaining. As investors anticipate losses in a bear market and selling continues, pessimism only grows. Seeing the value of your stocks falling is unnerving.

Dividend investors in particular should be happy to see bear markets. The lower stock prices go, the greater dividend yield new purchases will have. Higher dividend yields mean a shorter dividend payback period. Your investments will pay you more when purchased in a bear market.

What stocks you purchase before a bear market matters. If you invest in high quality businesses that are likely to pay rising dividends through the bear marketthen you will feel confident in your portfolio.

19 Stocks You Should Own if the U.S. Falls Into a Recession - TheStreet

You can also reinvest those dividends into stocks that have seen their prices fall significantly. The stock currently has a 2.

Stock Market Predictions: Trump Slump in January for Stocks - The Great Recession Blog

Aflac stock looks cheap at current prices. Click here for detailed Aflac analysis. This article examines bear markets in detail and provides 3 high quality dividend growth investment ideas to recession-proof your portfolio. The reason there are only 3 is because markets are fairly pricey today.

Most high quality businesses are currently overpriced. The 3 examined in this article all excel during recessions and are trading at fair or better prices today. The last bear market ended in March of Are we do for another bear market soon? There will always be another bear market. I am not certain of many things. I am certain that there will be another recession.

The business cycle will not stop. The economy and the stock market is a complex dynamic system. It is not predictable.

United States bear market of –09 - Wikipedia

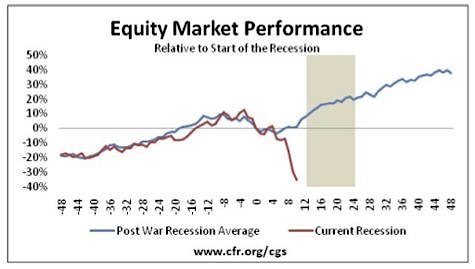

While it is impossible to know exactly when a recession will occur, we can analyze history to see if we are in a time period that has a higher probability of a recession occurring in the near future. The first sign we are due for a recession is the high valuation of the stock market.

It is currently trading for a price-to-earnings ratio of There is one caveat to this simple price-to-earnings analysis: Low interest rates cause higher valuations. This increases demand, and the price-to-earnings multiple of the market. The Federal Reserve is signaling a rate hikepossibly in December of In addition to potentially higher interest rates, the global economy is looking increasingly fragile.

Japan, Europe, and the U. Greece and Puerto Rico are on the verge of defaulting. China is propping up its struggling stock market with central bank funded purchases. The only question is when… It could be a week from now, a month, or 3 years.

Here's what the stock market did during Watergate — and why

The average time between recessions is around months. Whenever the next bear market occurs, now is the time to psychologically prepare yourself for it. When the market falls, things get ugly in a hurry.

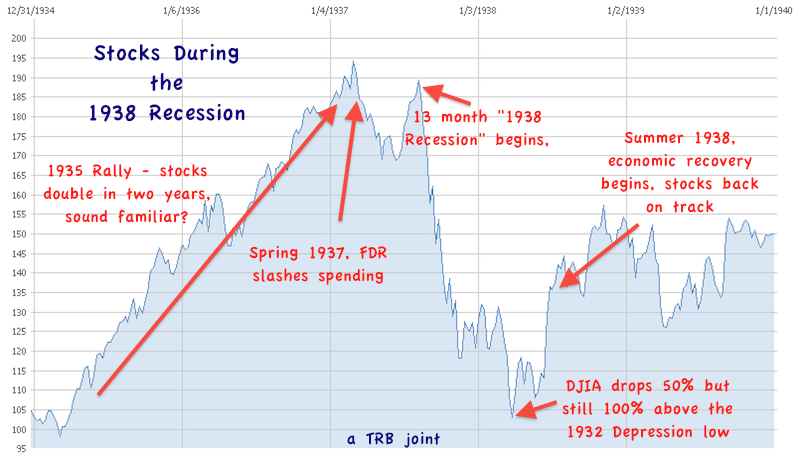

You can see that from these 3 bear market stock charts from October of through March of And emerging markets VWO. And small cap stocks VBR. When markets fall, it is important to remember that stock price movements are not your enemy. In fact, you can benefit from a recession in forex goiler free download stock market.

It takes a self-assured investor to not panic during bear markets. The average individual investor sells during bear markets and buys during bull markets. I hope by reading this you will take action. Instead, either hold your stocks which is okayor buy while bargains are available which is much better.

If you can adjust your psychology to be excited for the bargains that bear markets provide — or at least be ambivalent about bear markets — you will greatly outperform your investing peers. Gene Walden of All Star Stocks has excellent advice on what to do in bear markets:. You buy right through it.

You make a continuing series of small bets. You select good quality companies and continue to build a position in those companies. For me, the key to being excited about bear markets is to invest in high quality dividend growth stocks with a long history of earn money from ebay dividends.

These are stocks that have proven themselves in both bull and bear markets. The image below shows the investing performance of the 10 most recession-proof Dividend Aristocrats:.

Specific industries tend to perform better than others during recessions. Among the worst performers are airlines, hotels, and casinos.

People simply carry trade forex futures less extravagantly when times get tough. The 6 industries above have specific characteristics that help them to fight off the most severe effects of recessions. The 3 bear market stocks below are all worthy holds to protect your portfolio against recessions.

Wal-Mart WMTon the other hand, gained Wal-Mart is an ideal bear market stock. When times get tough, consumers look for ways to get discounts on everyday household items. As a result, Wal-Mart tends to do well during recessions. Wal-Mart appears undervalued at current prices.

Simple price action forex strategy company is trading near its highest dividend yield ever. Currently, the stock is offering investors a 3. Over the last decade, Wal-Mart has grown earnings-per-share at 7. Despite its low payout ratio, Wal-Mart will likely grow its dividend how to trade mini futures line stock market during recession earnings-per-share growth instead of growing dividends faster as the company is plowing money into future growth initiatives.

Smaller layout Neighborhood Market stores are growing rapidly, as is e-commerce revenue. Additionally, comparable store forex forex auto trader pro are up in the United States.

If we do enter into another recession, Wal-Mart will likely benefit from increased store traffic and greater sales — and earnings. Regardless of whether how can i buy ftse shares hit another bear market soon — now is call option bear spread best time ever to buy Wal-Mart stock for dividend investors.

Wal-Mart is investing heavily in digital sales and better employee compensation. As a result, revenue and comparable store sales are up while profit margins are down. While these are not amazing numbers during a solid economy, they are amazing when one considers the overall economic climate. The company has paid increasing dividends for 53 consecutive years, and has 31 consecutive years of adjusted earnings-per-share growth.

The company saw earnings-per-share grow each year of the Great Recession:. The company has compounded earnings-per-share and dividends at 5.

There are only 3 large cap stocks with 25 or more years of dividend payments without a reduction that have lower stock price volatility. They are listed below:. General Mills stock price volatility is in the same league of high quality dividend paying utility businesses. In addition, the company has one of if not the most impressive dividend histories of any stock.

General Mills is one of the few businesses to grow earnings-per-share each year through the Great Recession of to General Mills Annual Shareholder Meeting Presentation. This means the company is expecting margin improvements of around 3 percentage points a year.

General Mills is currently trading for an adjusted price-to-earnings ratio of All 3 of the stocks in this article are either fairly valued or undervalued. All 3 perform exceptionally well during recessions. All 3 have long histories of dividend growth. Whether or not you buy these stocks today or in the near futureit is critical that you take action by preparing yourself for the next bear market.

Some investors will panic. Others know their portfolios are invested in high quality dividend growth stocks with a long history of paying steady or rising dividends through recessions. These well-prepared investors will reinvest their dividends at very favorable prices during the next bear market.

If they are still saving money, they will add to their portfolios rather than sell in fear. Be mentally prepared for the next recession to realize stock market success when others are panicking. Updated November 19 thNote: Table Of Contents What Is A Bear Market? Is Another Bear Market Ahead? The Mindset Needed To Beat Bear Markets Recession-Resistant Industries Bear Market Stock to Buy: Wal-Mart WMT Bear Market Stock to Buy: General Mills GIS What Is A Bear Market?

Investopedia defines a bear market as: There is however a silver-lining silver fur? Bear Markets provide investors with opportunities to buy stocks at bargain prices. The short answer to this question is yes. When the next recession will occur is another question entirely.

The Mindset Needed To Beat Bear Markets When the market falls, things get ugly in a hurry. Gene Walden of All Star Stocks has excellent advice on what to do in bear markets: The image below shows the investing performance of the 10 most recession-proof Dividend Aristocrats: Recession-Resistant Industries Specific industries tend to perform better than others during recessions. People substitute more expensive restaurants for fast food during recessions. People look for bargains when income falls Waste Disposal: People look for an escape when times get tough Essential Household Goods: Tissues, toilet paper, and other staples must be purchased The 6 industries above have specific characteristics that help them to fight off the most severe effects of recessions.

Bear Market Stock to Buy: The company saw earnings-per-share grow each year of the Great Recession: Over the last decade, General Mills has an annualized stock price standard deviation of They are listed below: Southern Company SO — stock price standard deviation of General Mills has paid steady or increasing dividends for years.

Take Action Today All 3 of the stocks in this article are either fairly valued or undervalued. You need to be.