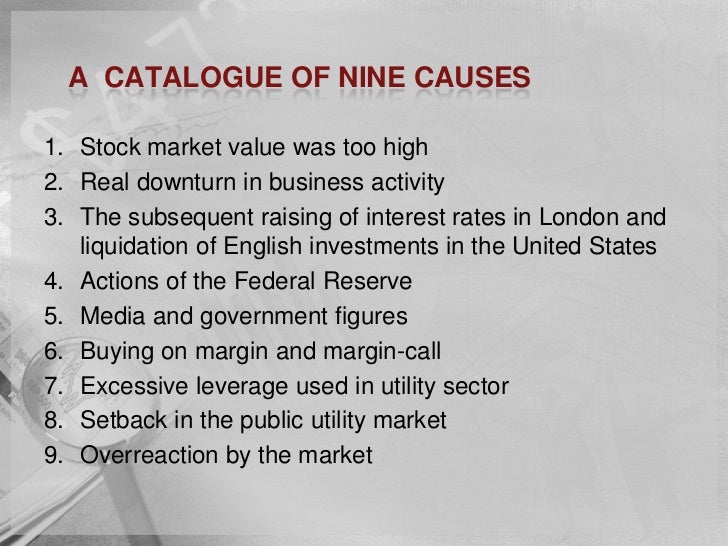

What causes the stock market crash in 1929

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

View general discussions about Khan Academy. Here are posts to avoid making. If you do encounter them, flag them for attention from our Guardians. Math by grade K—2nd 3rd 4th 5th 6th 7th 8th. Computing Computer programming Computer science Hour of Code Computer animation. Test prep SAT MCAT GMAT IIT JEE NCLEX-RN CAHSEE. Be specific, and indicate a time in the video: Isn't the sun way larger?

This discussion area is not meant for answering homework questions. Before asking, please make sure you've checked the top questions below and our FAQ.

What caused the stock market crash? I never understand economics. I would say the cause was the Federal Reserve artificially lowering interest rates creating a 'boom' due to everybody borrowing.

People borrowed money to invest in commodities, then when the fed raised interest rates it caused severe deflation with a sharp drop in the price of commodities and the stock market.

What caused the Stock Market Crash of that preceded the Great Depression? | Investopedia

Everybody sold off everything as the dollar grew stronger but there was a big decrease in the money supply so it became hard to expand the economy.

That's how I understood the root causes of the great depression We could have recovered from it much sooner if the government had backed off on spending, FDR's administration did not know proper economics. In there was a 'great depression' too but no one has ever heard of it. It was caused by the inflation of the money supply due to WW1 if I remember right.

It was actually worse than the first year of the real Great Depression in in terms of unemployment. The government halved spending incut taxes, and the Federal reserve stayed out of it and we recovered big time by the next summer. This is what I understand from what I've been learning about economics but you may want to fact check all of this but it gets you started.

A main cause was that way too much was being produced. Since people already had something, they no longer would purchase it. Since the companies had massive stockpiles of product due to no one purchasing it, they laid off workers since they were being less profitable and didn't need to make so much.

As a result of the companies' decreasing profits, stock traders sold stocks and it then fell into panic selling, and as a result the value of stock fell massively. Due to this, the economy crashed in the panic. This is to the best of my understanding.

Buckminster Fuller gave a simple explanation of the cause of the Great Depression. He explained that farmers borrowed a lot of money from banks to buy tractors and other farm related items.

A terrible harvest caused farmers unable to pay their loans. The banks repossessed many items from the farmers. Because so many farmers lost their possessions to the banks, it brought down the market for farmer related property that banks could not sell the properties for enough to make up for the money they loaned.

Smaller banks borrowed money form larger banks to loan money to the farmers and the smaller banks were not able to pay back the larger banks. Thus, the larger banks failed and triggered the Great Depression. There were no rules on inside trades then and for the first time the govt. This was the beginning of capitalism on a global scale and the results have been, as they always are, bittersweet.

Economics is a behavioral science - morality becomes relative to short term goals. It brings out the best and worst of us. If there is a lesson it might be cheaters never prosper, but all of us are involved in some way, and this is where it gets really crazy, because the United States, as our good Salman mentioned I believe had become a true democracy in the sense that all were citizens now and the economic well being of the nation had a direct impact on all of its citizens not just property owners.

A lot of people don't seem to understand that before the civil war there wasn't really a govt. The bill of rights nullified any grievance between property holders and those with nothing but labor to sell with the notable exception of the slaves, who weren't citizen; ergo - no rights. This is the seed of volatility and there is money to be made from predictable human behavior.

The majority of money rules and it always has. This is the one aspect of American history that stands out among its contemporaries is its honesty for the fallibility of king and country. History throughout recorded time has always been the story of kings and a democracy based on history flies in the face of that.

Freedom of speech allows us to say Nixon was tricky or not.

Nixon left no heir to defend his legacy. The truth always comes out eventually and that is always subject to interpretation. Something that must be interpreted objectively outside of competing political interests if one wishes to accurately predict an outcome. To put it more up Sal's alley, the expression must be evaluated. This requires a moral context -- this is not what the formal study of history is.

The genius of America is the facts are all there for all to see. It appears to this objective observer that people here in the U. It is not easy dealing with the worst of humanity in the past which is what tends to get remembered and ignoring it in the present - all historians do this, because the victors write the history which is us, which is the U. Now it gets political because the U.

So there are no simple answers to your question other than human nature. I love math after westpac nz foreign exchange rates liberal arts for the last 20 years. Its so innocent compared to some of the motives that employs it. The Byzantines used to believe God was punishing them when something bad happens, I think we tend to do the same thing in this day because the simple fact that most people would not want stop the evils we do even if they could.

It is simply easier to say God is punishing us for disobedience or something than to have to tell some one we like no or be contentious with an obviously false buy punj lloyd stock price target claim made out of emotion from someone we care about. If we studied in college instead of learning how to party we would know what cognitive dissonance is and learn from our mistakes.

Math is far less forgiving in this aspect than psychology. Math and psychology are on opposite ends of the scientific spectrum, but they are both evaluated or observed from a human point of view. Its like the law of large numbers. You just have to get close and you'll begin to see we'll leave precision for the more diligent in this instant. Money controls history not historians. After we're all dead, people will plainly see how dumb we were for appeasing Hitler wait And it's been passing the buck ever since.

What caused the Great Depression?

Bill Gates stole from Steve Jobs and he stole from Xerox and now were all about to go to war over who owns this great big obelisk in Washington D. Invention and innovation drives the economy Big fish have to pay little fish Libraries are a hedge on patents thank you Sal for restoring the Library at Alexandria ; which are meant to expire.

Not to say these men didn't invest labor into a work in progress and should have their due compensation. The law is mine, not the money. William of Occam proved simplicity tends to be the correct answer. Who enforces the Sherman Anti-Trust laws these what causes the stock market crash in 1929 I am just one lone soul. No one ever speaks for me what causes the stock market crash in 1929 least in govt.

No one said anything about Kent State, about slavery, or the police beating the hell out of protesters no one who wasn't paid by a media firm with vested political interests.

The Economic Causes and Impacts of the Stock Market Crash of (Fall ) - Historpedia

Your misery is political fodder and the politicians will take as much as you'll give. I know for a fact that people are complicit with condemning the innocent, but how far will we go to protect the guilty this we will see. The law my boy, is written for the wealthy and no one beside. The founding fathers understood this and made no bones about it. They left it solely in our hands to resolve. We can decide not to decide but not that the consequences don't apply to us because we're special or rich or really, really pretty.

Because why are we in the United States 'of' America to begin with? Everyone was trading their stocks, but when those companies started to lose money it rippled and made a larger effect in the market. Victroiana's answer of panicked people selling their stocks as quickly as they could leading to making stocks worthless is only part of the story. There is also the extra supply leading to call forwarding settings samsung galaxy s3 mini spending less money, leading to low funding, causing many products to be discontinued and unemployed people which makes people with not much money for a low variety of products, cycling around and worsening the situation and causing the stock crash as well by making stocks worthless.

Well i hope this is helpful 1 ,people worried about money 2. THEY bought less 5 soon many many people bought less 6 many businesses closed 7 many people lost their jobs 8 that kept on going that's the great depression i hope they are the same thing. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. Economics are almost worse then Biology and Algebra combined The main cause of the stock market crash was extreme over production from World War I.

This caused prices of food to go way down. This got to the point where farmers were dumping milk down the sewers while children were starving in futile attempts to get the food prices back up. Another cause was the heavily unregulated stock market. Stocks were being bought and sold for way more than they were actually worth paying thousands of dollars for stocks worth barely hundreds. So, multiple bollinger bands strategy the stock market actually crashed, people lost thousands rather than hundreds of dollars which threw the economy into the Depression that was always coming.

The stock market crashed because the people asked for money from the bank that they never paid back. And when you do this the bank takes your home. People had state money to buy stocks but the couldn't pay it back.

Stock Market Crash of - Facts & Summary - efulejeqih.web.fc2.com

Another way to look at all of these great answers is that Wall Street did NOT reflect what was happening in the country. The markets were slowing down with the difficulties farmers were having with their crops as well as other factors, but the trend on Wall Street was the opposite: There were basically no limits, so people were doing whatever they wanted to, including high levels of unsafe speculation. The values on Wall Street did not match the decreasing values in the country.

To many people where trying to sell and not enough people where buying stock. This led to Black Tuesday, the day the stock market crashed and the Great Depression started. Most of the response is inaccurate at best. The credit bubble caused just like credit bubble in real estate caused the "GreatRecession".

John Kenneth Galbraith's book - The Great Crash is pretty much indispensable if you want to learn more. His thesis, and it's as good or better than most out there, was that confidence flagged - for a long time during the boom-time value for securities wasn't in line with it's value - and leverage was used rather excessively - but in the end people began to doubt the inflated values and there was a crash in stock prices.

It's important to look at how a crash in the stock market before then an unserious portion of the investment world could bring about a Depression as big as the '33 Depression. The Wall Street Crash of Octoberalso known as the Great Crash, and the Stock Market Crash ofwas the most devastating stock market crash in the history of the United States, taking into consideration the full extent and duration of its fallout.

Anyone who bought stocks in mid and held onto them saw most of his or her adult life pass by before getting back to even. Salsman[ question The Roaring Twenties, the decade that led up to the Crash,[4] was a time of wealth and excess. Despite the dangers of speculation, many believed that the stock market would continue to rise indefinitely.

The market had been on a six-year run that saw the Dow Jones Industrial Average increase in value fivefold, peaking at In the days leading up to the crash, the market was severely unstable. Periods of selling and high volumes of trading were interspersed with brief periods of rising prices and recovery. Economist and author Jude Wanniski later correlated these swings with the prospects for passage of the Smoot—Hawley Tariff Act, which was then being debated in Congress.

Several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor. Lamont, acting head of Morgan Bank; Albert Wiggin, head of the Chase National Bank; and Charles E.

Mitchell, president of the National City Bank of New York. They chose Richard Whitney, vice president of the Exchange, to act on their behalf. With the bankers' financial resources behind him, Whitney placed a bid to purchase a large block of shares in U. Steel at a price well above the current market. As traders watched, Whitney then placed similar bids on other "blue chip" stocks. This tactic was similar to one that ended the Panic of It succeeded in halting the slide.

The Dow Jones Industrial Average recovered, closing with it down only 6. The trading floor of the New York Stock Exchange injust six months after the crash of Over the weekend, the events were covered by the newspapers across the United States. Salsman wrote that "on October 29—amid rumors that U. President Herbert Hoover would not veto the pending Hawley-Smoot Tariff bill—stock prices crashed even further".

Durant joined with members of the Rockefeller family and other financial giants to buy large quantities of stocks in order to demonstrate to the public their confidence in the market, but their efforts failed to stop the large decline in prices. The ticker did not stop running until about 7: The market then recovered for several months, reaching a secondary closing peak i.

It would not return to the peak of September 3, until November No one wanted to buy,they just sold their stocks. There was black Sunday, and then the stock market crashed. Answer this question or Cancel Formatting tips.

Share a tip When naming a variable, it is okay to use most letters, but some are reserved, like 'e', which represents the value 2.

This is great, I finally understand quadratic functions! Post a tip or thanks. Question for US History overview 2: Reconstruction to the Great Depression. Have something that's not a question about this content?

Post a tip or thanks Join our help discussions Report a technical problem with the site Request a feature. Thank the author This is great, I finally understand quadratic functions! Have something that's not a tip or thanks about this content?

Ask a question Join our help discussions Report a technical problem with the site Request a feature.