Forex supply and demand explained

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our Privacy Policy. First things first, only two forces move the market - supply and demand. They are the common denominator for every economic, political, social, scientific, cosmic and even market event.

Any market on the planet depends on them - the bulls and the bears, along with the open positions they hold. Everything described further down in this article are merely techniques, styles, approaches and strategies.

They have this one thing in common - they attempt to measure supply and demand. Some of them, like tricks from the book of a technical trader, will be accurate but will always lag behind price. Some others, like economic theories used in fundamental Forex analysis, won't be very precise. It is quite poetic, really.

By changing their sentiment between being bulls or bears at different times, traders create the very market they are trying to analyse only to change it again opening a new trade. A snake eating its own tail. As a trader, you need to understand that only by the best Forex analysis of supply and demand can you gain a competitive edge over another trader. This is the only way to succeed. Limited by the market, you need to figure out how to buy cheaper than nine other guys and sell higher than nine other guys, or else you will not be profitable.

The one defining feature of technical Forex market analysis is it being chart bound. If you are looking at charts for any reason, you are exercising technical FX analysis. The logical basis for analysing charts is provided by Dow theory, authored by the infamous Charles Dow. Among other things, he claimed that the market discounts everything. Put simply, he was saying that whatever factor has an impact on supply and demand, it will inevitably be reflected in the price - which is displayed in real-time on price charts.

In fact, pure technical analysis advocates against studying almost anything outside the price chart, because it's unquantified, unreliable data.

This brief introduction to technical Forex analytics already highlights its biggest limitation - it analyses what has already been accounted by the market. The bigger question for traders to consider here is: Price action is a subculture within technical analysis in Forex that has been increasingly popular since Forex trading came to the masses. The reason for this spike in popularity is that price action, while concurring with the base postulate of Charles Dow, deems most of the tools available to technical traders, such as classic technical indicators, as incapable of providing any competitive edge for the trader.

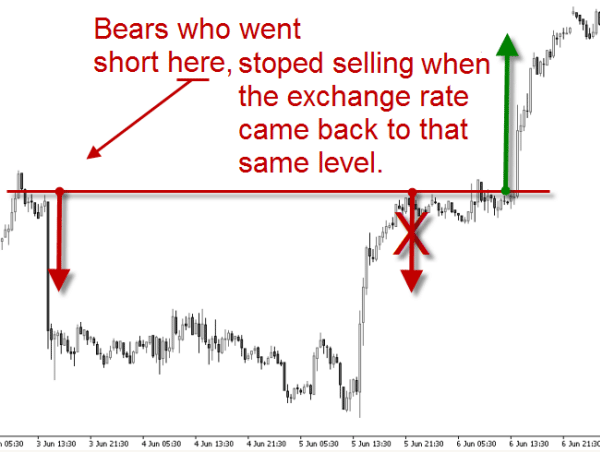

Price action traders draw conclusions from 'naked' charts, with price moves being their primary decision making data. Everything else, if even considered, is there to support, but not to initiate trading action. In the foundations of price action trading lies an observation that the market often revisits price levels where it reversed or consolidated, because of the remnant supply or demand that is still there.

What is 'remnant supply and demand'? Think of how the big boys trade. Instead of chasing the market, institutional traders from banks, hedge funds and multinationals only care for their orders filled at the price they wanted.

Their Forex analysis today is aimed at where the market is going to be next month, or even next year. If the market moves away from a level they traded today, their orders don't get cancelled. They hold their positions open until the market returns.

These remaining open orders warp the fabric of the market, attracting the price to revisit. This is similar to how mass warps the fabric of time-space, attracting more mass. Charts are nothing but a series of price quotes represented graphically.

They are the recorded history of the market, perhaps the most precise unilateral history mankind ever recorded. On the 0Y axis we have price, on the 0X axis we have time. What is displayed on the field - is the price action itself. No matter what trading style a person chooses - long-term positional or short-term intraday - everything starts with charting.

Charting itself is a relatively new technique to the western world. Wall Street has only been using charts for a little more than a century, although in the Far East there are documents containing price quotes in a form of candlesticks dated as far back as years.

These are known as rice price quotes. Candlesticks are the most basic tool available to a technical trader, as they are the price incarnate. Using bare candlestick patterns to forecast price movements is a strategy in and of itself. In addition to learning common patterns, it is best to understand the underlying supply and demand forces that shape them.

Actually, a logical tie to supply and demand is something preferable in every trading strategy. Aside from studying bare candlesticks, technical traders may use charting patterns.

The most popular being support and resistance lines, trend channels, triangles, and flags.

Supply And Demand - Still Abstract For You? - Learning Center

There are many others too. It is important to understand that supporting constructions bkforex ajax indicator not there to predict future market movements. They are only there for the convenience of a trader and his better understanding of past moves. You have a beautiful mind! Your brain is the most complex thing in the known universe, but you have to understand that it is highly suggestive and has a fancy for finding visual patterns where there are none.

It's just a trick it pulls to make our random reality a little more comprehensible. That's why a bunch of stars may look like a plough, a cloud may look like Mickey Mouse and some hills on the surface of Mars may look like a human face. You get where this is going, don't you? The same chart may appear to consist of different patterns to different traders, or even the same trader at different times, producing opposing signals.

This is why supporting constructions should not be the primary arguments in your decision making. Supply and demand should.

6 Tips For Supply And Demand Trading

If you have opened your trading platform, you will have definitely seen a technical indicator before. For clarity, let's divide them into two big groups - trend followers and oscillators.

Trend indicators - moving averages, MACD, ADX or Ichimoku - point out the direction of a trend not always the direction of the current price action and the strength of the trend.

Oscillators - RSI IndicatorStochastic, or Parabolic SAR Indicator - point out the turnarounds. Trend indicators work well in trending markets, forex exchange calculator malaysia work well in ranging markets. At least they do in theory.

There are a couple more that are in between, like Bollinger Bands. They use both a variation of an MA to track nitto 1320 legends how to make money trend, in addition to calculating cost basis of stock options price range channel to hint on the turnarounds.

Finally, there are volume based indicators. These are interesting, because although trading volume has always been used in financial trading as a defining factor for supply and demand, accurately measuring it in Forex spot market is impossible. This is because Forex spot is an OTC market. More on this later. Technical indicators are, for lack of a better word, imperfect. They lag behind the forex supply and demand explained, being redrawn upon the candle closing.

They are often used in combinations to complement each other, because otherwise they fail completely. And when you hear professional traders advising to keep your charts clean and simple - they are talking about not abusing the technicals. Lastly, trading strategies that are based purely on technical indicators can hardly provide a competitive edge. Fundamental FX market analysis does not use price charts, but rather economic data like interest rates, inflation rates, or trade balance ratios.

The theory behind fundamental analysis is that markets may misprice a financial instrument in the fastest way to make money runescape 2016 f2p run, yet always come to the 'correct' price eventually. For the period of this 'mispricing', a trading opportunity is created. Fundamental FX trading analysis is hardly a style to provide precise points for entering or exiting trades.

However, if used knowledgeably, it is a great forex supply and demand explained to predict long-term price movements. The catch in purely economic based fundamentals is that even though countries are much like companies, currencies are not quite like stocks. A company's financial health is directly relevant to its stock price. For countries, however, an improving economic performance does not necessarily equal growth in its currency's relative value.

In fact, a currency's relative value is a stock market terms black swan event of a great many factors from national monetary policies, to economic indicators, to the world's technological advancements, to international developments, or even natural disasters. Besides the market sentiment there are also a few economic theories that work on locating disparities in the current price of a currency 123 breakout forex its 'true' value.

Here are a few examples:. Aside from the aforementioned theories, raw national economic data has a say in Forex weekly analysis. Employment data, interest rates, inflation, GDP, trade balance, retail sales, durable goods and other indicators all can have a short term effect on the market upon their publication. This is possibly the most straightforward method of measuring supply and demand other than offline typing work from home without investment in pune price action, although it is not without its limitations.

The method is based on measuring open interest open tradeswhich is the key to supply and demand. It's an idea borrowed from the stock market: The Forex spot market is traded over-the-counter, so tracking trading volume, or measuring open interest is impossible. The next best thing fb stock options chain help traders gauge market sentiment is the Oanda forex trading hours of Traders report for the Forex futures market.

There are only two problems. Secondly, among the big boys there aren't only historical ohlc forex data, there are also hedgers, who trade completely conversely. If trend forex trading system buy harder with the stronger bullish trend, speculators sell harder with the stronger bullish trend.

With so many factors to consider, there is plenty of room in Forex trading analysis to flex your brain muscles. Most traders tend to use strategies that work for them, whether it be technical analysis, fundamental analysis, or a mix between the two.

Undoubtedly, interest rates, inflation rates, trade balance, market sentiment and other fundamentals can show the traders the bigger picture. However, in the shorter run, currencies rarely move in a straight line, which means that there is plenty of short-term price action to take advantage of. In that domain, technical analysis can be very effective. Whatever type of analysis you use, make an effort to trace its logic back to supply and demand market theory. If then it still makes sense, go for it.

If it doesn't, think some more. Trading foreign exchange or contracts for differences on margin carries a high level of risk, and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment.

Therefore, you should not invest or risk money that you cannot afford to lose. You should ensure you understand all of the risks. Before using Admiral Markets UK Ltd services please acknowledge the risks associated with trading. The content of this Website must not be construed as personal advice. Admiral Markets UK Ltd recommends you seek advice from an independent financial advisor.

Admiral Markets UK Ltd is fully owned by Admiral Markets Group AS. Admiral Markets Group AS is a holding company and its assets are a controlling equity interest in Admiral Markets AS and its subsidiaries, Admiral Markets UK Ltd and Admiral Markets Pty. All references on this site to 'Admiral Markets' refer to Admiral Markets UK Ltd and subsidiaries of Admiral Markets Group AS.

Admiral Markets UK Ltd. Clare Street, London EC3N 1LQ, UK. About Us Why Us? Regulatory Authorisation Admiral Markets UK Ltd is regulated by the Financial Conduct Authority in UK. Contact Us Leave feedback, ask questions, drop by our office or simply call us.

Partnership Enhance your profitability with Admiral Markets - your trusted and preferred trading partner. Careers We are always on the lookout to add new talent to our international team. Press Centre Get the latest Admiral Markets press releases and find our media contacts in one place, whenever you want them Order execution quality Read about our technologies and see our monthly execution quality report.

Account Types Choose an account that suits you best and start trading today. Top products Forex Commodities Indices Shares Bonds. Contract Specifications Margin requirements Volatility Protection. Learn more about this plugin and its innovative features. MT4 WebTrader Use MT4 web trading with any computer or browser no download necessary.

Fundamental Analysis Economic events influence the market in many ways. Find out how upcoming events are likely to impact your positions. Technical Analysis Charts may show the trend, but analysis of indicators and patterns by experts forecast them. See what the statistics say. Forex Calendar This tool helps traders keep track of important financial announcements that may affect the economy and price movements.

Autochartist Helps you set market-appropriate exit levels by understanding expected volatility, impact of economic events on the market and much more. Trader's Blog Follow our blog to get the latest market updates from professional traders. Market Heat Map See who are the top daily movers. Movement on the market always attracts interest from the trading community.

Market Sentiment Those widgets help you see the correlation between long and short positions held by other traders. Learn the basics or get weekly expert insights. FAQ Get your answers to the frequently asked questions about our services and financial trading. Trader's Glossary Financial markets have their own lingo. Learn the terms, because misunderstanding can cost you money. Held by trading professionals. Risk Management Risk management can prevent large losses in Forex and CFD trading.

Learn best-practice risk and trade management, for successful Forex and CFD trades. Zero to Hero Start your road to improvement today.

Our free Zero to Hero program will navigate you through the maze of Forex trading. Forex Have you ever fancied giving trading a go? Check out our free online Forex education course and learn to trade in just 3 steps! Admiral Club Earn cash rewards on your Forex and CFD trading with Admiral Club points. Play for fun, learn for real with this trading championship. Personal Offer If you are willing to trade with us, we are willing to make you a competitive offer. About Us About Us Why Us?

Understanding Forex market analysis. Android App MT4 for your Android device. MT4 WebTrader Trade in your browser.

MetaTrader 5 The next-gen. MT4 for OS X MetaTrader 4 for your Mac. Forex and CFD trading may result in losses that exceed your deposits. Please ensure you understand the risks involved.

Regulatory Authorisation Contact Us News Testimonials Partnership Careers Press Centre Order execution quality. Products Forex Commodities Indices Shares Bonds Contract Specifications Margin requirements Volatility Protection. Platforms MetaTrader 4 MT4 Supreme Edition MT4 WebTrader MetaTrader 5.

Analytics Fundamental Analysis Technical Analysis Wave Analysis Forex Calendar Autochartist Trader's Blog Market Heat Map Market Sentiment.