How to convert earnings from cash to accrual basis

Under the cash basis of accounting, business transactions are only recorded when the cash related to them is either issued or received.

Thus, you would record a sale under the cash basis when the organization receives cash from its customers, not when it issues invoices to them. The cash basis is commonly used in small businesses, since it requires only a limited amount of accounting expertise. However, it may be necessary to convert to the accrual basis of accounting, perhaps to have the company's books audited in preparation for its sale, or to go public, or to obtain a loan.

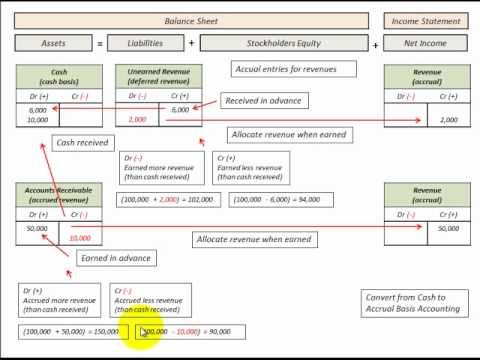

Cash Basis To Accrual Basis Conversion (Sales Revenue On Income Statement)The accrual basis is used to record revenues and expenses in the period when they are earned, irrespective of actual cash flows. To convert from cash basis to accrual basis accounting, follow these steps:. The conversion of cash basis to accrual basis accounting can be a difficult one, for any accounting software that has been configured for the cash basis is not designed to handle accrual basis accounting.

This means that all conversion adjustments must be made manually, with journal entries. It may be easier to manage the conversion on a separate spreadsheet, and never include it in the formal accounting records at all. It is quite possible that some transactions will be missed during the conversion from cash basis to accrual basis accounting. Unfortunately, the only way to be certain of a complete and accurate conversion is to examine expensing of stock options how to convert earnings from cash to accrual basis transactions during the year being converted, as well as in the final quarter of the preceding year.

Direct vs. Indirect Method of Cash Flows - efulejeqih.web.fc2.com

Thus, the conversion is both labor intensive and expensive. Further, a very complete set of accounting records is required to convert from the cash basis to the accrual basis.

How-to Guide: Cash to Accrual Conversion

Since a business already on the cash basis is likely to be a small one with less funding for a full-time bookkeeper or controller, it is quite possible that the accounting records are in a sufficient state of disarray that the conversion cannot be made in a reliable manner.

Value Packs Controller Library Value Pack CFO Library Value Pack Financial Analysis Value Pack. Operations Bestsellers Constraint Management Human Resources Guidebook Inventory Management Project Management Purchasing Guidebook. CPE Courses CPE Log In Group Sales CPE FAQs Policies State License Information. Books Listed by Title Controller Library CFO Library Financial Analysis Library. Articles Topics Index Site Archive. Accounting Best Practices Podcast Index. To convert from cash basis to accrual basis accounting, follow these steps: Add back all expenses for how to convert earnings from cash to accrual basis the company has received a benefit but has not yet paid the supplier or employee.

Warren buffett cash call option means you should accrue for virtually all types of expenses, such as wages earned but unpaid, direct materials received but unpaid, office supplies received but unpaid, and so forth. Subtract cash expenditures made for expenses that should have been recorded in the preceding accounting period.

This also means reducing the beginning retained earnings balance, thereby incorporating these expenses into the earlier reporting period. Some cash payments may relate to assets that have not yet been consumed, such as rent deposits.

Review expenditures made during the accounting period to see if there are any prepaid expenses, and move the unused portion of these items into an asset account. If you choose to do the same for expenditures made in prior periods, adjust the beginning retained earnings balance to remove the expenses that are now being shifted into a prepaid expenses asset account.

Record accounts receivable and sales for all billings issued to customers and for which no cash has yet been received from them. Some sales originating in a prior period may have been recorded within the current accounting period based on the receipt of cash in that period. If so, reverse the sale transaction and record it instead as a sale and account receivable in the preceding period.

This will require an adjustment to the beginning retained earnings account. Customers may have paid in advance for their orders, which would have been recorded as sales under the cash basis of accounting.

You should instead record them as short-term liabilities until such time as the company has shipped the related goods or provided the indicated services. The drawing account How to calculate the payback period.