1987 stock market crash program trading

Learning about the Stock Market Crash of is just as important as understanding what happened during the Stock Market Crash of Many historians argue there were similarities between the two crashes, and that appears to be true. There also seem to be several distinct differences between these historic events. In the first half of , the U.

Not Found - Bunkerstation Heijmen

The increase in exports provided U. In fact, most of was marked with one stock market record after the other.

There had been a great deal of corporate restructuring in the preceding years, and American companies were promising strong future earnings growth. International investors also took notice of the improvements in the U. In September , the economic concerns over the weak dollar and rising interest rates started making investors nervous. Volatility in the market increased dramatically as both good and bad economic information was in the news.

A record single day point gain for the Dow was set on September 22nd, only to be followed by the largest single day point loss on October 6th. The volatility of the market created a great deal of anxiety over the weekend. Investors were left wondering what would happen on Monday.

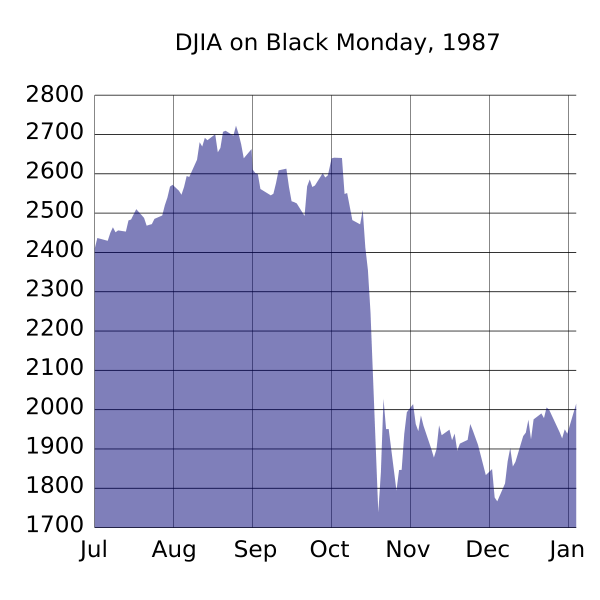

On Monday October 19, , the stock market plummeted right from the opening bell. No one was looking to buy stocks that day, and the problems in the stock market soon spread to the futures market. The technology advances in the stock exchanges began to kick in, and these computerized systems accelerated the decline.

Program trading was a new tool, and was introduced to take advantage of rapid market movements. On Black Monday, program trading moved millions of shares, and clients as well as investment houses were left wondering what their actual market positions were like for most of the day.

Portfolio insurance professionals also contributed to the stock market crash of through their electronic trading systems. As these computerized systems analyzed the events of the days prior to Black Monday, they flooded the market with sell orders. Portfolio insurance and program trading were intended to help investors take advantage of short-term market fluctuations. Unfortunately, these two systems, along with a lack of investor confidence, drove the Dow Jones down points.

Following the stock market crash, the federal government conducted a study of the events of Black Monday. There was a great deal of concern, and interest, in determining the conditions contributing to the stock market's crashing.

After examining the findings of those reports, the Securities and Exchange Commission introduced several new measures of control into the stock market in an attempt to prevent a reoccurrence of the events of Black Monday:.

The Stock Market Crash of

As the market index rose over the years, the original circuit breaker levels no longer made sense for these stock exchanges. The current rules for the stock market can be found on the NYSE Euronext's website.

On a final note, the market rebounded remarkably following the stock market crash. The market began a slow and steady climb almost immediately.

In fact, before the end of , the Dow Jones Industrials would once again be setting new record highs. Most scholars attribute this rapid rebounding to the fact that the underlying fundamentals of the market were still strong, and the Federal Reserve took quick action in the months following the crash to bolster international confidence in the American economy.

About the Author - The Stock Market Crash of Last Reviewed on November 22, The Stock Market Crash of Learning about the Stock Market Crash of is just as important as understanding what happened during the Stock Market Crash of The Stock Market before October In the first half of , the U.

Black Monday () - Wikipedia

Additional Resources Stock Market History Stock Market Crash of Stock Market Crash of In fact, most of was marked with one stock market record after the other. Black Monday On Monday October 19, , the stock market plummeted right from the opening bell. What Caused the Stock Market Crash of ? After examining the findings of those reports, the Securities and Exchange Commission introduced several new measures of control into the stock market in an attempt to prevent a reoccurrence of the events of Black Monday: The circuit breaker halts trading if the Dow Jones Industrial Average declines a prescribed number of points in a prescribed amount of time.

Rebounding from the Crash On a final note, the market rebounded remarkably following the stock market crash. Stock Market History Stock Market Crash of Stock Market Crash of